As your startup begins to experience growth, you may find yourself in a position to seek out venture capital as a means of scaling your business accordingly.

Of course, there are plenty of alternative measures available to grow your business. Bootstrapping is the most difficult but ultimately rewarding if you manage to navigate your endeavour towards success without losing any equity. While angel investors can be great for small but significant windfalls. However, if you really want to grow fast to cater to growing demand or show your ambition, venture capitalists are capable of supplying millions of pounds for a company with a solid business plan and clear vision – VCs are also capable of investing at any stage throughout your business’ lifespan.

Venture capital has the power to unlock significant levels of funding for businesses, however, it’s important to note that due to the sums of money involved, this process can be extremely long-winded and distracting. For some businesses, the receipt of significant investment can secure their survival while failure to do so could lead to insolvency. Because of the size of the stakes on hand, it’s important for entrepreneurs to have as clear of an idea as possible about the ins and outs of raising venture capital funding, so here’s a deeper look at the processes involved and how business owners can make their pitch as appealing as possible to those who have the power to secure their future.

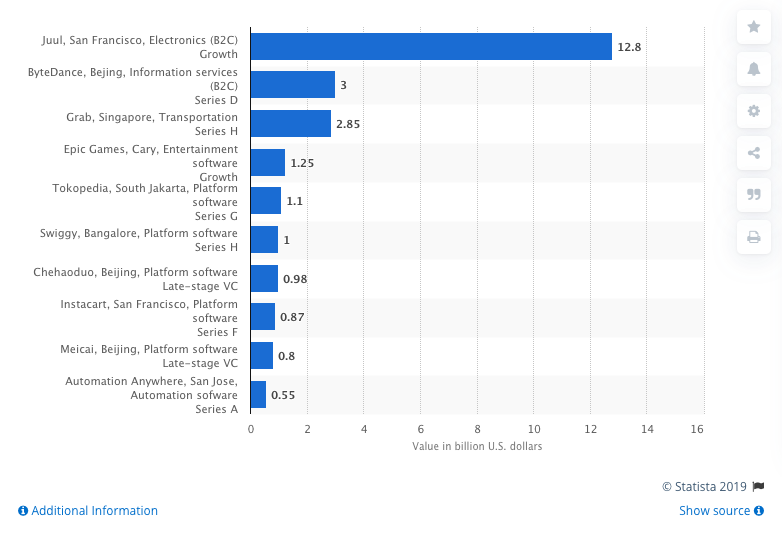

(Leading VC backed companies in 4th quarter 2018, by value of investment. Image: Statista)

Assess and reassess your business

You’ll be hard pushed to find an entrepreneur who decided to commit to an idea that they didn’t believe in. Of course, this is a good thing – the stronger you feel about your endeavour, the more conviction will be on show when it comes to pitching your ideas.

However, you’ll be very lucky to find a venture capitalist who shares the same level of initial enthusiasm. Your passion for your project is an asset, but it may also take you too close to the subject matter, leaving you with some holes in your pitches and answers to questions.

Be sure to take a step back and assess your business and its viability as if you’re an outsider looking in. Think about whether it appears viable for VCs and if there’s enough evidence of their money being required to ensure sustained growth.

It’s also important to look at the market in which your business is immersed. Is there room for your business to facilitate the returns on investment that you’re promising? If the market isn’t large enough to accommodate your growth, the chances are that there will be no VC investment.

Putting your business under this level of scrutiny is also instrumental in ensuring that you’ll know exactly how much investment you require; this could work wonders in confirming whether you indeed need the help of venture capitalists or, in fact, your company can get the boost it needs from a more commonplace smaller scale bank loan.

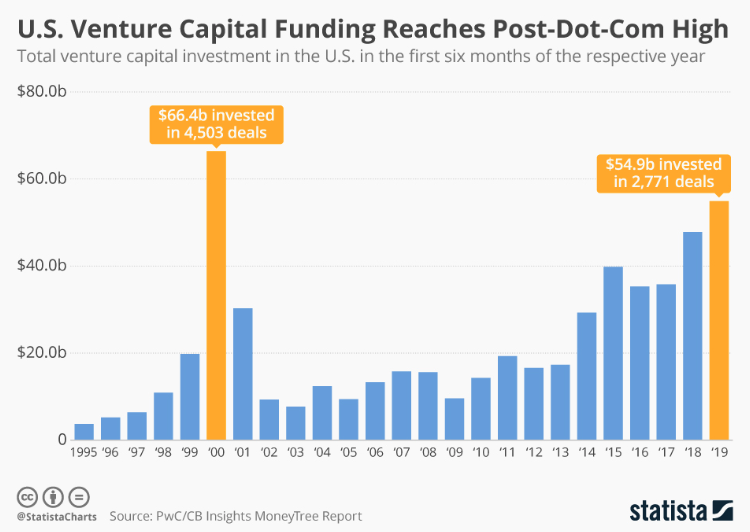

(Chart showing U.S. VC funding. Image: Statista)

Work to understand all angles of your VC funding

Naturally, venture capital is designed to benefit everybody involved in a deal – and as a business owner, it’s worth taking a moment to understand all of the angles involved in the funding process.

Venture funds consist of both general and limited partners. General partners have a more hands-on role in managing money while limited partners typically supply capital as a means of more passive investment.

The way general partners in venture capital funds make money is two-fold. Firstly through the implementation of management fees (this is typically 2% of the overall size of the fund) and secondly through a process called ‘carry’ – which generally involves receiving 20% of the returns. Carry is often applied once the fund returns all capital to limited partners – meaning VCs make no profits until all the original funding is paid back.

With these figures in mind, it should shed a little light on why venture capital firms write cheques and allocate the level of funds that they do. Borrowing an analogy from Entrepreneur, “If the fund has $50 million, it does not make sense to write $100,000 cheques. They won’t be able to deploy capital quickly enough (a typical venture fund is set up to deploy all capital over four years). Similarly, a $150 million fund is not likely to put $30 million into a series A of one company.”

Be sure to discover the typical cheque size and its respective sweet spots for the VC funds that you’re planning on partnering with.

Never underestimate the power of networking

You’ll no doubt be familiar with the notion of networking to help your business grow by now – and will have surely spent plenty of time building allies in the places necessary to successfully enter the market. Now it’s time to call on your networks in order to optimise your relationships for securing investments from the people who matter.

Sadly, Rome wasn’t built in a day, and the process of acquiring VC funding will invariably take time. Ideally, networking will help you to meet potential investors early in your scaling process in order to introduce them to your idea and provide a strong sense of who you are and what your vision is for your endeavour.

Of course, it’s not a good idea to produce a fully-fledged pitch to someone when it’s too early to provide tangible evidence for success, and it’s important to have at least a working prototype pertaining to the products that you’re offering. After all, you would hardly be willing to lend money to somebody you don’t know very well without receiving proof that they will be able to return it.

Networking is an excellent tool for earning trust. Be sure to establish yourself on prospective investors’ respective radars sooner rather than later – doing so could make all the difference when it comes to securing a healthy level of funding on your terms later on.

Dedicate time to narratives and pitches

Your narrative can be just as important as your overall pitch in many cases. Yes, you have a well-sought-out USP, and your ambitions are backed up by data, but what about your story? How did your business get here?

Don’t be afraid to dedicate time to sharing your background – especially the parts that have moulded your character into what VCs see today. How has your background led to the formation of your idea? Can your experience be relevant in helping you achieve your goals?

Remember that Venture Capitalists are not only investing in your company, but also investing in you as the person who will deliver a return on their investment. Don’t shy away from showing your character as a successful founder or leader.

Of course, it’s worth reiterating that you should allocate enough time to mastering your pitch, too. Your prospective investor will be looking to ask difficult questions in order to make sure that your endeavour suffers from no drawbacks or weaknesses.

Make sure all of your bases are covered and work on anticipating the more left-field questions that may be asked and include them in your pitch.

A good tactic here is to work on an ‘elevator pitch,’ which is essentially a method of condensing your points and ambitions into a considerably short amount of time. Once prospective VCs attain a solid overview, you’re free to delve deeper into the arguments you want to make.

Take on the 30-10-2 rule

The 30-10-2 rule is a good model to follow when seeking investment, and can make for a good yardstick for monitoring your progress alongside industry norms.

Essentially, the 30-10-2 rule relates to the ratio of investors that will take an interest in your startup. If you find 30 potential investors to network with prospectively introduce your proposal to, 10 are likely to want to meet with you to discuss your ideas further – so it’s worth taking the time to get to know these VCs. Of this figure, around two investors may want to invest in your business.

The 30-10-2 rule illustrates how much of a numbers game it can be in securing venture capital. It’s possible to expand on this approach by categorising your list of 30 VCs into three categories – ‘A’, ‘B’ and ‘C’ – based on the priority in which you would like to pitch to them.

Think before deviating from your terms

Securing your initial deal with a venture capital firm may feel like a great end to an arduous pursuit of funding – but sadly the work doesn’t stop at Series A.

As Digify notes, “the terms of the deals you write for Series A, however, are unlikely to disappear. Many of them will follow you into your Series B and C efforts and beyond. For that reason, it’s important to make sure that you get the terms of your investor funding right the first time.”

Here, it’s vital that you work to guarantee your funding for the foreseeable future. Be sure to work with fellow founders or a trustworthy contemporary to make sure that the terms you agree on make good business sense at the first time of asking.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)