Wealth management is an industry that’s experienced widespread change in the 21st Century alone. The emergence of new technologies coupled with larger inter-generational asset transfers, all set to the backdrop of a world recovering from a significant financial crash just 10 years ago has caused plenty of disruption to the norms of wealth management.

Now that we’re on the precipice of a new decade, it’s time to look into how the next ten years will change the way we look after our money. How will the 2020s influence where we invest our money? And will the industry continue to evolve in the face of new technologies and mechanics? Here’s a deeper look at the key trends that look set to take hold in the near future:

The arrival of the Great Wealth Transfer

The single most disruptive influence on the wealth management industry will come in the form of the Great Wealth Transfer – and there’s plenty of evidence to suggest it’s already underway.

CNBC reports that within the next 25 years, as much as $68 trillion will be transferred from the Baby Boomer generation down to younger family and friends. This seismic shift in wealth will be felt across the industry of wealth management, and businesses will need to act fast in bracing themselves for not only a huge increase in demand but an entirely different type of client.

A higher proportion of clients will belong to the Millennial generation and will have a completely different outlook on how to interact with wealth management firms. Long-term clients from the Baby Boomer generation, many of whom will likely know their advisors personally after years of service, will pass their assets on to younger generations who are much more used to machine-based interactions and less face-to-face communication.

Today, the youngest ‘Boomers are around 55-years-old, while the oldest are 73 and already beginning to embrace retirement. According to the US Census Bureau, there are roughly 74 million citizens that fall into this age bracket.

It’s reasonable to argue that the biggest trends of the next decade will be forged by wealth management firms attempting to adapt to the Great Wealth Transfer. Expect a considerable push towards modernisation in the industry as well as a strong level of scaling from companies looking to brace themselves for a new wave of clientele.

Embracing automation

Shifting customer bases will create a need for automation as firms bid to offer better levels of security for clients’ assets.

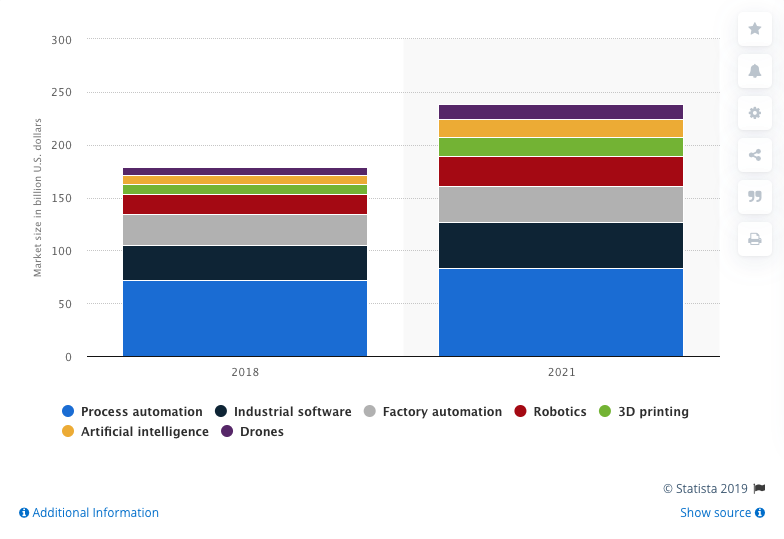

Given the collective value of the assets at stake, technology can’t enter the wealth management landscape until its considered reliable enought. But with the development of machine learning, artificial intelligence and their respective aptitude at processing and interpreting big data, we can expect widespread adoption of automated risk assessment in the coming years.

(Image showing global automation market size in 2018 and 2021. Image: Statista)

On the topic of automation within wealth management, Warren Hatton Jones, Temenos CoE co-Lead at Deloitte said: “Recent advancements in artificial intelligence technologies have significantly reduced the cost of research and offer comparison for customers; such development and potential new solutions will further disrupt existing operating models amplifying the returns for large-scale players and creating new opportunities for niche and agile innovators.”

Automation has become something of a dirty word in modern times. People associate the phrase with the loss of jobs to machines and a diminishing need for skilled workers. But there’s little reason to be fearful when it comes to wealth management, at least.

Deloitte notes that automation won’t mean the end of human interaction. Widespread adoption of automated technologies within the field of AI and machine learning will pave the way for a hybrid approach to the interpretation of big data. Here, trusted advisors will be equipped with all the information they could possibly need in order to make accurate and prosperous decisions as to the best way to invest their clients’ money.

Experience fuelling loyalty

The coming decade will also see wealth management firms working to enhance their customer experience models.

Analytics coupled with the cognitive capabilities of AI will pave the way for exponentially enhanced levels of personalisation within the industry. This significant shift in approach will fundamentally change the method of engagement from a customer-acquisition-focused activity to one that looks to ensure the best possible customer experience through all stages of their journey with a company.

As the clientele using wealth management firms continues to shift towards generations with more experience in computer literacy, the need for interconnectivity will be greater. We will begin to see wealth management firms invest more in creating fresh avenues for communication for clients over the next few years.

Furthermore, by developing new avenues for communication, firms can create new approaches for data gathering, decision-making and delivery. By doing so, they can open the door to personalised, contextualised, tailor-suited individual experiences for each user and client online.

By embracing artificial intelligence solutions, wealth management firms can thoroughly examine a user’s want, needs, opinions and behaviour to develop a personalised experience that suits their personality and encourages actions to be taken.

Newfound industry prominence

PricewaterhouseCoopers believes that 2021 will be a watershed year for asset management to take centre stage.

Changing demographics and the huge market shifts that will come as a result will pave the way for much wider prominence for the industry. PwC explains their expectations for the rise in demand for asset management solutions in four points:

Point one stems from heavier regulation hindering bank and insurers – leading them to abandon proprietary investing and other core businesses.

Point two notes that as the world ages, retirement and healthcare will become pressing issues that ‘only’ asset management can solve.

Point three focuses on the rising importance of asset managers in raising the capital required to support urbanisation as well as cross-border trade.

And point four hinges on how asset managers will be at the centre of efforts by SWFs to diversify their wide field of assets.

Wealth management firms find themselves on the precipice of a disruptive decade for the industry. They’ll need to adapt at a rapid rate to accommodate a shift in clientele and cater to their more modern needs.

It’s fair to say that the Great Wealth Transfer alongside modern technological advances in AI and machine learning will cause some disruption in the industry and the first firms to adapt may well reap the rewards of what looks set to be a massive new client base.