From ancient civilizations, through modernity and the 21st century, gold has been the preferred storage of value. Some have argued that gold is merely a barbaric relic that no longer holds the monetary qualities of the past. As we know, modern society has turned to paper currency as the preferred storage of value. Can the rise of digital currencies and financial technology be said to render paper currency obsolete? Probably not.

On the other hand, there are those that strongly assert that gold is an asset with many intrinsic qualities that make it unique and ever-more necessary for investors to hold gold in their portfolios. With that said, what are the reasons to invest in gold? And is gold-investing still as lucrative or as safe as in the past?

Why should investors buy gold?

As we know, gold has been around for a long time, played a significant role in many economies and has been relied upon as a unit of currency. Although this is no longer the case, it is still a reliable, long-term investment and holds a significant place in an investors portfolio. This is particularly true during periods of economic stagnation and downturn.

Inflation hedging

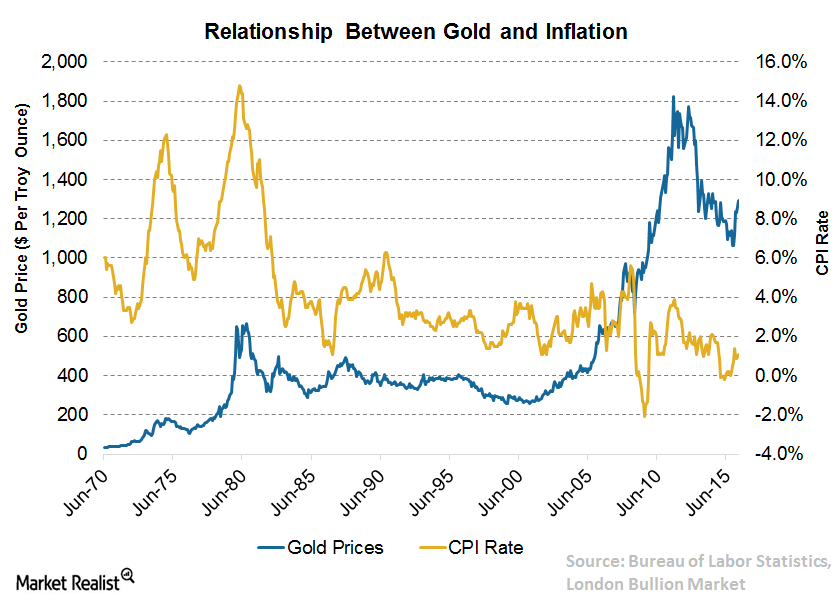

Over the last 50 years, gold has performed better as a hedge against inflation shocks to the economy. Today, many investors buy gold as a hedge against political turmoil and inflation. In simple terms, the price of gold tends to rise in accordance with the cost of living. This unique quality is what earns gold its place in not only securing sound returns but also in order to lower overall portfolio risk.

(Inflation expectations and the price of gold. Image: MarketRealist)

In theory, if the dollar loses value from the effects of inflation, gold becomes more expensive. The owner of gold, therefore, is ‘hedged’ against the falling dollar. As inflation rises and erodes the value of the unit of currency, the cost of each ounce of gold will rise respectively. The investor is then compensated for this inflation for every ounce of gold they own.

Relative performance

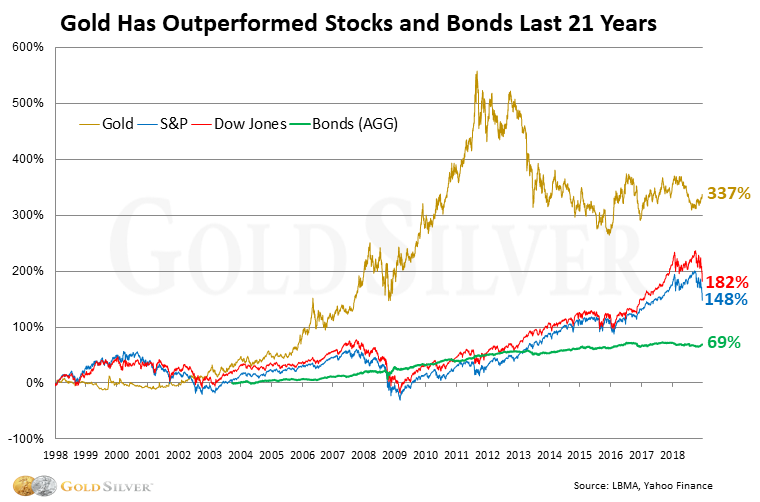

The price of gold can fluctuate in the short term, but over the long-term, it can indeed outperform riskier asset classes such as equity and property. It has historically performed better given economic variances, its hedging capabilities, demand as a means of investment and low volatility.

Unlike stocks and bonds, the return on gold is entirely based on price appreciation. However, investing in gold carries unique costs. Since it is a physical asset, it requires storage and insurance. These factors should be taken into account for gold to perform well in a diversified portfolio.

Diversification

Historical records show that the value of gold doesn’t move in the same way as stocks and bonds. Stock market dips and peaks do not appear to affect the value of gold. Meaning, it’s a good way to diversify your portfolio.

Portfolio diversification means spreading out your investments over different asset classes. This way – if one decreases in value, there’s a chance that the other investments will offset the decrease. It’s important to note that when you’re investing in gold, diversification within this asset class should be addressed differently.

It’s not good practice to put all money into different types of gold investments. If the price of gold decreases, most types of gold investments will decrease in value accordingly. Nothing is certain in the investment world. Whilst the amount of gold is finite, a huge amount of it could be discovered tomorrow – depreciating its value.

Therefore, investing in gold requires careful consideration, only a portion of your investment capital, and a combination of other asset classes.

Gold tax advantages

Investing in bullion bars – that is, gold before coining and is valued by weight – is tax and stamp duty-free in the UK and the EU. Taxing regulations vary between countries and may be less advantageous in other countries like the U.S.

It’s wise to consult a tax professional to determine how your investments in gold will be taxed. Do this before you invest so that tax costs can be factored into your investment strategy, risks can be assessed and returns can be calculated.

How to invest in gold

Investors have just as many methods to invest in gold as they do reasons for investing. They can buy gold through Exchange Traded Funds (ETFs), buying the stock in gold miners and associated companies, or buy the physical product.

Buying physical gold

Gold is perhaps the most accessible commodity to the average investor. The actual yellow metal, coins and bars can be found on high streets, metal dealers, banks and brokers. For maximum liquidity, most buyers stick to the widely circulated coins.

Gold, as we know it, can be bought in the form of jewellery, coins, bullions and gold bars. Each offers different investment prospects and should each be adopted to fitting investment strategies. When curating your investment strategy, you should consider the costs that go into each type of physical gold.

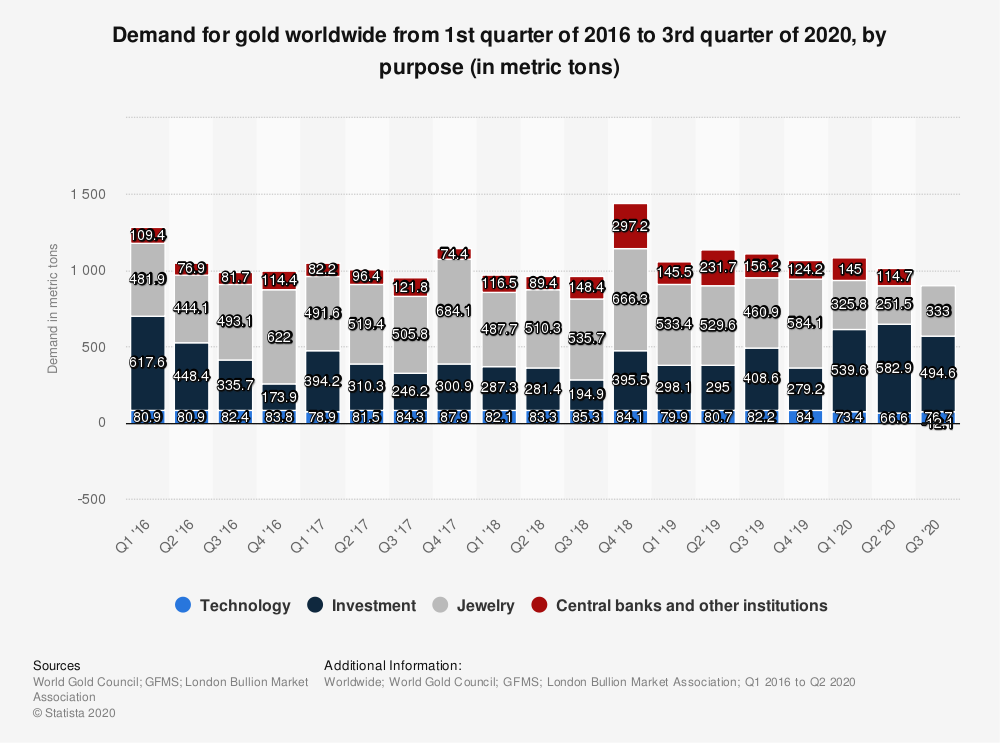

(Demand for gold by purpose 2016-2020. Image: Statista)

Jewellery is often invested in as a form of art. The time and skill it takes to craft jewellery results in high prices; of which do not always necessarily make it the best investment for those looking for pure gold exposure. The global demand for gold for jewellery, however, is significant. The industry certainly helps to stabilize the value of gold.

Coins are collectable items. Whilst there is still gold value to be found, it certainly increases with rare and desirable coins. Once again, however, these gold coins cost more to purchase than the price of physical gold.

Bullion and bars are no exception to additional costs. They too have their creation costs to get them into their final form. Companies selling gold bullion must also store the precious metal as well as make a profit. This drives up the market price above the true value of the gold.

Should I invest in physical gold?

It’s accessible, collectable and largely low risk. Holding Physical gold might suit some investor strategies’ perfectly well. But let’s delve into some of the main reasons why physical gold should be approached, bought and sold with caution.

One of the benefits of owning physical gold is that you can hold it in your hands. The drawbacks of owning physical gold are that you need to hold it – if not in your hands, then somewhere safe. This often involves safeguarding and insuring your gold.

One way to store the gold you invest in is to rent a safe deposit box at a bank; which incurs another cost. There are also fees that you may be required to pay in order to buy and sell gold. You pay a premium over the spot price of gold because of markups from sellers. You can also end up getting less than the price of gold when you sell it to other investors who are looking to make a profit from processing the gold.

In short, physical gold is worth holding on to because it is a universal finite currency that is held by most central banks. However, some argue that buying physical gold should not be regarded as an investment pursuit, but rather a form of saving. It’s simply a good, stable store of value that can be liquidated when desired.

(Performance of Gold versus stocks and bonds 1998-2018. Image: GoldSilver)

Invest in physical gold to diversify your portfolio and help offset the risks of your alternative asset classes. Do, however, factor in the fees associated with buying and selling and the costs of storage.

Buying Gold ETFs

Owning gold without the hassle of physical ownership and storage obligations is possible by purchasing an Exchange Traded Fund (ETF) that essentially buys gold on your behalf. The gold is bought and stored for the owner of the ETF. Additionally, the owner can buy and sell their shares at any time without having to find a willing buyer.

SPRD Gold Shares, initiated in 2004, for example, is one of the oldest ETFs available. Shares are traded on the New York Stock Exchange and can be traded just like stock. Each share of the ETF is equivalent to one-tenth of an ounce of gold. SPRD trades solely in bullion, allowing investors to see the precious metal’s price movement without consideration of other factors. Alternative funds invest in bullion and in shares of publicly traded companies of gold production, mining and refining.

What are the risks of investing in an ETF?

Gold stocks have a history of rising and falling more rapidly than the price of the metal itself. Each listed company is also subject to external factors unrelated to bullion prices. Political factors and environmental concerns can seriously affect a company’s share prices.

As such, investing in gold ETFs is somewhat riskier than purchasing gold for its value string capabilities. It does, on the other hand, come with appreciation potential; this cannot always be said of investing in bullion.

The convenience of investing in an ETF also comes at a cost. The burden of purchasing, storing and insuring the gold is passed on in monetary value to the owner of the ETF. These costs should be accounted for in an investors portfolio to avoid overstating the value of the investment.

Investing in Gold Futures Options

Such contracts allow investors the opportunity to buy the right to purchase an agreed amount of gold in the future at a set price. They represent the right, but no obligation to buy and sell gold at a set price for an agreed period of time. Options can be used by the investor when they think the price is going up or down. Regardless of the outcome, the maximum risk associated with buying options in gold is the premium paid to enter the contract.

As with all investments, there are high rewards and risks with gold futures investing. Rewards can be found in the flexibility of paying a certain amount when a deal is made; followed by the remaining amount on an agreed date.

So, if investors are able to sell quickly, there’s a chance they’ll never have to pay for all the gold they purchased. Instead, they repay 2% upfront and any loss is adjusted on a down payment and paid back in net.

In contrast to ETFs, futures are more straightforward. Investors buy the right to buy and sell gold at their discretion without management fees or interference, and taxes are split between short-term and long-term capital gains. Without a middleman, investors, at any time during the contract, ultimately own the underlying gold.

What are the risks associated with Gold Futures Options?

As the price of gold changes, so too does the value of the contract. Every day, inexperienced investors should understand that they usually won’t have to pay everything upfront. Often only a portion of the price of the contract is paid – this is called leveraged investing. If the price goes up, the investment could produce substantial returns.

Unfortunately, if the price decreases, investors will be expected to pay the rest of the amount due, which can seem like additional money above what was already invested in a seemingly futile investment.

The fact that these contracts are based on specific agreed-upon dates means that investors cannot wait it out, and hold the contracts during a downturn in hope that it will eventually rebound. And the gold futures market can be volatile, meaning that there is a chance it could collapse at any given moment.

Investing in Gold Company stock

Without getting your hands on any gold directly, you can always invest in gold mining stocks. It’s important to remember, however, that gold stocks do not always necessarily move in concert with the price of bullion. The success of a gold mining company is based on their operating performance, their use of capital and ability to generate profit. Unlike other methods of investing in gold, there is no security of owning the metal if the company fails.

A good strategy would be to own mutual funds or ETFs in many gold mining or gold production companies to reduce risk and advance potential returns. There’s a great chance that one particular mining company’s stocks will decrease, but you’ll be left with the others that might be performing better. Do keep in mind, however, that if the price of gold decreases – falls in the value of stock across all mining companies should in theory replicate one another.

The drawbacks of owning an ETF or mutual fund apply equally to gold mining ETFs – including the fees payable for the investment to be managed.

When to invest in gold?

What is well-timed gold investment? With perfect foresight, we’d all know the answer already. Investing in gold, in its physical form, is primarily used to store wealth in a stable and reliable medium to preserve the value of money in uncertain times.

In today’s financial climate, global tensions are high, political turmoil continues in the West, relentless cyberattacks ensue, low-interest rates and climbing inflation, not least the devastating impact of the Coronavirus pandemic; it’s fair to say that we are in uncertain times.

Investing in gold is typically a good idea when:

- Confidence in the stock market is declining

- Banks are unstable

- Global, regional and national political situations are uncertain

- Other asset classes are declining in value

Inflation

Government spending has been high in 2020 as the public sector forks out to pay for the immediate effects of the global pandemic. Fiscal stimulation in the U.S, UK and much of Europe mean inflation could rise. As a result, some predict the price of gold to drop. In contradiction with these predictions, history has shown us that gold has withstood inflationary pressures and is used as a hedge against inflation.

To shed some light on the purchasing power of gold, consider the following: in 1920, an ounce of gold used to buy the same as $20. Now an ounce of gold is worth upwards of $1000.

Investor confidence

In theory, the price of gold tends to increase when investor confidence in economic markets is low. That’s why gold is seen as a protector of wealth and a valuable hedge against other investments. Currently, investor confidence is weak as we enter into a recession. The stock markets have seen unprecedented hits and we cannot be certain of our future.

Political landscape

The price of gold is, to a degree, influenced by political and social factors. Understanding the political landscape can give investors a better understanding of when to invest in gold. Take, for example, the continued high prices of gold in the UK following the political turmoil of Brexit in 2016.

The trends are clear; political uncertainty favours gold. Amidst Brexit, Donald Trump, trouble in the Middle East and the Eurozone; gold has been favoured as a way of protecting wealth.

Personal circumstances

Investing in gold is a good way to protect and consolidate acquisitions of wealth. Following a large and perhaps sudden gain in capital – it’s sensible to protect as much as possible. It’s for this reason, so many invest in gold after inheritance.

It’s also desirable to diversify your newly acquired wealth and using gold’s steady value as part of a diverse investment portfolio is a good way to do this. Meaning, even if your portfolio already contains different investments it’s always a good time to invest in gold.

Gold vs silver vs stocks vs bitcoin investments

Comparing gold to a variety of asset classes is a good way to reveal its strengths and weaknesses. Arguably the closest asset to gold is silver. Whilst cheaper, silver has much of the same monetary history to gold. In fact, part of the reason the British currency is called the pound sterling is that it used to be a pound of sterling silver.

The differences between gold and silver help to shed light on their investment prospects. Silver has a significantly higher demand than gold for industrial use. This means that the value of silver can increase during sound economic periods too. Gold is classified as a precious metal over anything else. Although the jewellery industry helps to boost its demand.

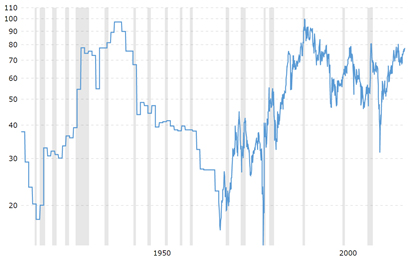

The gold to silver ratio tells you how many ounces of silver it takes to buy an ounce of gold. The graph below shows 100 years of data and illustrates the gold to silver ratio.

Gold to Silver ratio

(100-year trend gold to silver ratio. Image: Macrotrends)

The high points in the chart indicate moments when silver is cheap and gold is expensive relative to each other. It’s a useful tool and metric to use when assessing whether to invest in gold or silver.

Buying gold as a store of value is very different from investing in it to make money. Unless the price of gold soars over time, it’s merely a good way to protect your cash. Investing in gold stocks incurs risks and rewards of owning a stake in a company – just as with all stocks.

The bitcoin boom has prompted investors to compare cryptocurrencies to gold. Indeed, many cryptocurrencies are backed by gold. Both are regarded as non-financial assets, meaning they can trade outside of the financial system. It’s possible to escape the financial system and simply hold your wealth in either of them.

Both the value of gold and bitcoin price tend to respond similarly to geopolitical changes. The demand for each of them increases when the political climate is unstable. They’re both turned to and so both experience upticks in value in political instability. The difference being, cryptocurrencies are digital and intangible. Gold is historically proven, stable and is a physical asset.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)