Disclaimer: Stocks fluctuate widely in prices and are, therefore, risky to trade and/or invest. Past performance does not guarantee future results. When trading or investing, your capital is at risk. Decisions are yours to make. We do not advise to invest nor trade any specific stocks, and can not be held liable for the accuracy of the information below.

The main two classes of assets investors use in their portfolios are stocks and bonds. Investors are often advised to buy both in order to diversify. Put simply, stocks are shares of a company that represent ownership. Thereby transferring part-ownership of a company to a shareholder. Bonds, on the other hand, represent debt. In other words, investors effectively lend money to a company (company bond) or other organisation like the government, which is paid back with interest.

Stocks are typically considered riskier and more volatile than bonds but can also be more profitable in the long term. It should be remembered that there are many different kinds of stocks and bonds – with varying degrees of volatility, risk and return.

Overview of the asset classes

| Stocks | Bonds | |

| Instrument | Equity | Debt |

| Definition | Capital raised by a corporation through the issuance and distribution of shares. | A debt security, in which the issuer owes the holder debt and is obliged to repay the principal and interest. |

| Holders | Shareholder | Bondholder |

| Type | Securities | Securities |

| Issued by | Stocks are issued by corporations or joint-stock companies. | Issued by public sector authorities, credit institutions, companies and supranational institutions. |

| Participants | Market maker, Floor trader, Floor broker | Investors, Speculators, Institutional Investors. |

| Derivatives | Credit derivative, Hybrid security, Options, Futures, Forwards, Swaps | Bond option, Credit derivative, Credit default swap, Collateralized debt obligation, Collateralized mortgage obligation |

| Risk | High risk – high reward | Low risk |

How are bonds and stocks valued?

The price of a stock is determined by what buyers and sellers on the exchange are willing to accept on any given day. In other words, the basic economic principle of supply and demand has an impact on stock prices.

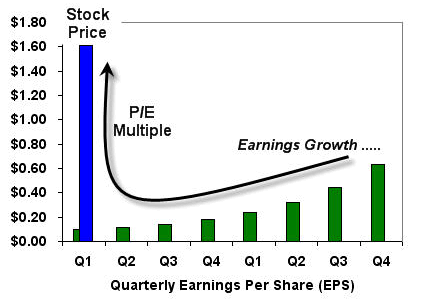

Typically, the value of a company is determined by that of its assets. One way to measure this is to look at the company’s assets minus liabilities. The net present value of all future earnings is also a key pricing factor. The expectation of business growth may increase the price of its stocks – even if it’s currently a loss-making enterprise. Consider companies like Amazon, where current earnings may be small but the value of the company’s assets and expectation for growth is so high, that the company is valued at billions of dollars.

Bonds are a slightly different story. Bond prices are based on how rating companies like S&P, rate the creditworthiness of the issuer of the bond. For insight, consider Apple – rated at AAA – meaning the rating agency has high confidence in Apples’ ability to repay the bond debt that the bondholders own. Apple is unlikely to default on its loans; so the company can borrow at very low-interest rates.

Bond prices and bond yields

(Relationship between stock price and earnings per share. Image: Investopedia)

Bonds can be valued in two ways; a daily value (price) on the bond market where bonds are bought and sold. Second, a long-term return value (yield) where investors earn back the principal cost of the bond plus interest.

The relationship between the two is incredibly interconnected. When the price of a bond goes up on the market – the yield decreases and vice versa.

External factors influencing the valuation of stocks and bonds

Things that happen outside of the organisation, most of which can not be controlled also affect the price of its shares and bonds. When the economy is stagnating, the expected value of future earnings is low and all share prices tend to fall. Investors should know how to navigate a stagnating economy. Equally, a strong economy indicated by low unemployment and increased GDP, confidence in the market grows.

The impact of money supply on the prices of bonds and stocks is clear. When interest rates are lowered, a number of consequences inflate share prices. First, more money in the financial system increases inflation and generates a rise in share prices. Second, bonds become less lucrative when interest rates fall- so investors chase higher returns on stocks.

Diversified portfolios: types of stocks

Stocks typically exist within two main categories of common stock and preferred stock. The latter is further divided into non-participating and participating stock. Most investors will buy and sell common stock of different types. Well-performing, diversified portfolios include a range of different types of company stocks.

Stocks by sector – The Standards & Poor’s 500 index organises the stocks it follows into 10 main sectors and more industries. This makes it easy for investors to devote a certain percentage of their investment portfolio to the sectors they care about.

Investor tip: when investing by sector, remember to invest in a variety of industries to lower risk.

Stocks by size – Small, medium and large companies coincide with small-cap (market capitalisation of $300 million to $2 billion), mid-cap (market capitalisation of $2 billion and $10 billion) and large-cap companies (market capitalisation of $10 billion and above). Large-Cap companies are typically the most stable. However, it is the mid-cap companies that are watched closely by investors because of their growth potential.

Stocks by growth – Some are faster growers than others and have the potential to generate a good return – but they can be risky – these are growth stocks. Stocks that are more stable in the market are value stocks which are likely to give some return but may have spikes and dips in value.

Regional stocks – investors aren’t limited to one area of the world but rather, can invest in local and overseas markets. Investing in international funds enables investors to put money into whichever markets are stable. For example, Western Europe’s riskier emerging markets, Latin America’s or a combination of more.

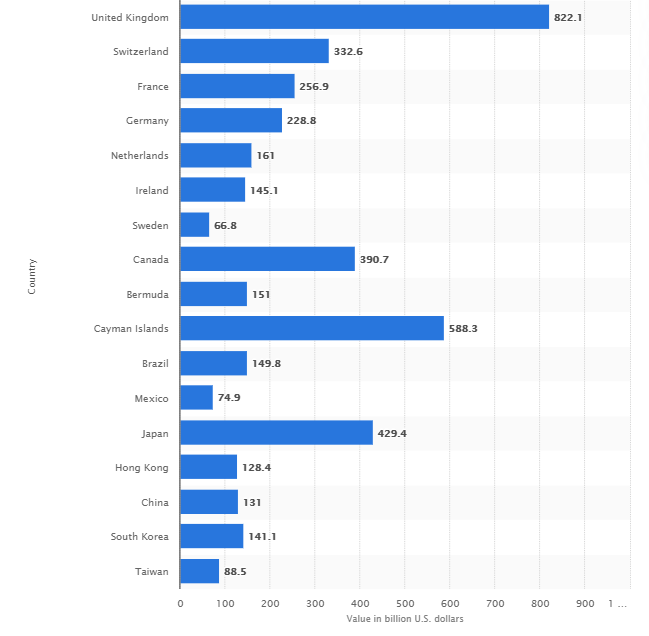

U.S. holdings of foreign stocks and bonds in 2012, by country

(U.S. foreign investment in stocks and bonds by country. Image: Statista)

The graph above shows the level of U.S. investment foreign stocks and bonds. Regional stocks are clearly a popular way to diversify an investment portfolio, minimise risk and find new opportunities.

Index funds can be a good alternative to the factors listed above. The idea is that on the whole, an index will grow and produce a return, while some stocks within the index fund will decrease in value. The NASDAQ-100, for example, lists the top 100 large-cap stocks in the NASDAQ. An investor can put their money in the fund and the index will evenly divide it between all the stocks.

How investors make money with stocks + investment tips

The first thing investors look for when investing is good, strong, stable and growing companies that are likely to see an increase in stock prices. They’ll want to buy stocks in companies with consistent revenue and profit growth – so picking the right companies with solid potential is essential.

Consider companies like Apple and Amazon, for example, those who bought and held stocks in these companies were rewarded with immense profits as the companies multiplied their revenues and earnings over time, causing their stock prices to soar. There’s no telling when the next Amazon will hit the stock market, but there are a few indicators to look out for when investing to make the big bucks.

Not all investors invest in individual stocks to make money. In fact, most don’t. Whilst there are plenty of different brokers that make investing simple for regular investors, many choose to invest in ETFs or mutual funds that hold a basket of different stocks.

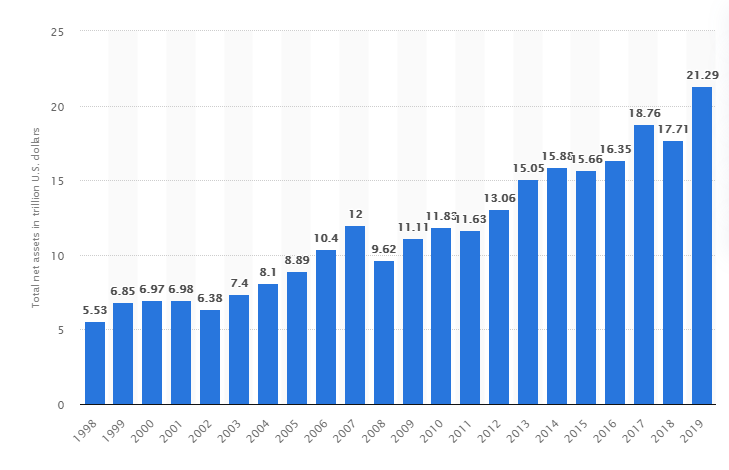

Net assets of U.S-registered mutual funds worldwide over the past 20 years

(Total net assets of US-registered mutual funds 1998 – 2019 in trillions of dollars. Image: Statista)

Funds that hold all the companies in the S&P 500 index are growing increasingly popular since these funds have historically provided good returns. Stocks and funds can return money to investors through dividend payments, typically paid out quarterly.

Unlike bonds, these dividends cannot be guaranteed. In fact, they can be increased, decreased or even cut entirely if the company feels that it needs to preserve cash. And which companies don’t need to preserve cash or reinvest it into the business? A solid dividend payment is indeed more common among mature companies that don’t have as much scope or need to invest in growth.

What are the risks in investing in stocks?

Investing in general, of course, comes with risks. Most affect the market or the economy and calls for investors to adjust their portfolios or ride out the storm. Aside from the obvious cases of a company going bust or not being able to pay its shareholders’ dividends, there are more risks to consider.

One of the most obvious risks for investors comes from the state of the economy. The fact is, the economy can take a turn at any given moment. The effects of a stagnant or damaged economy can last for decades. Consider the market crash in the 2000s and the terror attack on September 11, 2001; the economy settled into a sour spell. A combination of factors saw the market indexes lose percentages. When the market recovered, it plummeted to new lows in 2008.

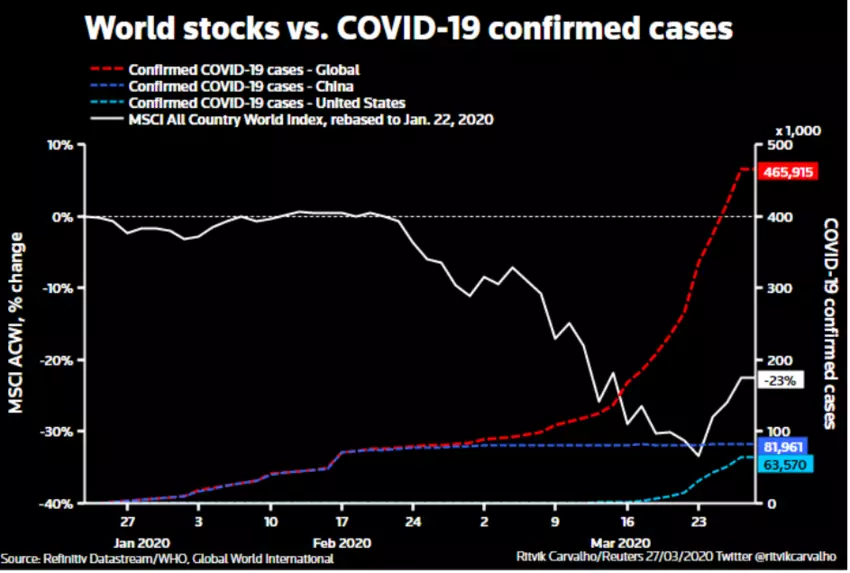

Unforeseen and unexpected events such as global pandemic can cause significant dips in the value of world stocks. Refer to the graph below and note the plummeting value of world stocks following the experiential rise of confirmed Covid-19 cases globally.

(The effects of Covid-19 on world stocks. Image: World Economic Forum)

Market value risk is always possible and sees the market turning against or completely ignoring your investment. It can often happen when the market pursues the ‘next hot thing’ and leaves good but often unexciting companies behind. Good stocks and bad stocks suffer as investors leave the market.

Finding security in stocks

Inflationary risk is always imminent and if it’s too high, it can destroy value and spur recessions. To combat inflationary risk, can sometimes be as bad as the problem. Governments will often evoke large borrowing programmes to fund stimulus packages, meaning it’s only a matter of time before inflation reoccurs.

In such situations, investors turn to hard assets like real estate and gold, because they’re likely to withstand inflationary pressures. Since inflation erodes the value of an investors income stream, stocks are a good investment alternative because companies can adjust prices to reflect the rate of inflation. It’s by no means a perfectly recession-proof investment solution, but certainly contributes to why investors opt to maintain some of their assets in stocks.

(Image: Statista)

Stocks are amongst adult American’s most preferred long-term investments. Whilst real estate and other tangible investments in gold and precious metal are also strong, 28% of U.S. adults say they prefer the stock market for money they don’t plan to use for the next 10 years.

The Bond Market

In the simplest terms, these loans made to an organisation are a form of debt and appear as liabilities in the organisation’s balance sheet. One of the main differences between stocks and bonds is that stocks are usually offered in for-profit corporations, whereas any organisation can issue bonds. They are also traded on exchanges but typically have a lower volume of transactions than stocks. So, how can you find the best bonds to invest in?

The bond market is synonymous with the credit market and allows investors to issue new debt in the ‘primary market’ and buy and sell debt securities in the ‘secondary market’. The debt market is the arena in which these transactions occur. There is no single physical exchange, rather transactions are mostly made between brokers, large institutions and individual investors.

Types of bonds

Corporate bonds – true to their name, corporate bonds are where investors borrow money to corporations. They are one of the riskier types of bonds but the potential for return is far higher. Investors utilise bond ratings to avoid investing in high-risk corporate bonds. Rating agencies like Fitch and S&P assess and publish the creditworthiness of a corporation.

Government bonds – The bondholders of government bonds are in effect loaning money to a government. Established nations are effectively never going to default on this type of loan. The principal of the bond is paid back in full over time, with interest attached. It is indeed possible to invest in other countries’ bond markets. Whilst safe to do so, they’re unlikely to yield a significant return. However, investing in developing countries is risky but could be profitable.

Zero-coupon bonds – these bonds are typically sold at a discount and have a fixed interest rate that is only paid out upon bond maturity. Meaning, there are no periodic interest payments from these bonds. Rather, the interest accrues over time. They are, therefore, good long term investments.

Why investing in bonds is less risky than stocks

The first thing to mention is that the volatility of bonds – short and medium dated bonds in particular – is lower than that of stocks. It’s for this reason that bonds are generally considered safer investments than stocks. In addition to this, bonds, by far, suffer less day-to-day volatility than stocks. So much so, that the interest payments of bonds can sometimes be higher than the average level of dividend payments.

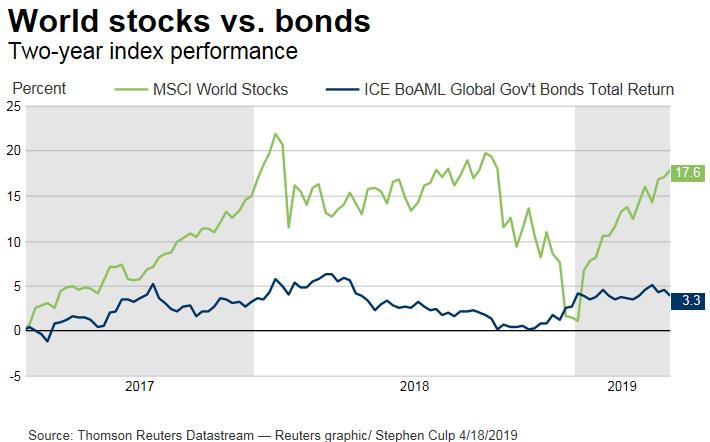

(World stocks vs. bonds 2017-18. Image: Reuters)

The performance of the stocks shown in the index above is far more volatile than the relatively stable performance of global government bonds. But do take note of the staggering difference in performance by Q4 2019. Does the potential for high returns offset the risk?

Bonds are more liquid. It is generally quite easy for an institution to sell a large number of bonds without affecting the price much. At least, it is easier to do this relative to stocks. Ultimately, bonds are an attractive investment because of the certainty of a fixed interest payment made quarterly or twice a year, as well as a fixed sum at maturity.

Bondholders have the upper hand when it comes to security. They enjoy a measure of legal protection since under the laws of most countries if a company goes bankrupt, its bondholders will receive some money back. In the case of stocks, the company effectively ends up valueless with no reserves for shareholders.

In addition to this, bonds come with a formal debt agreement that established the terms of a bond issue – an indenture. Clauses within it, specify the rights of bondholders and the duties of issuers – including the actions that the issuer is obligated to perform or is prohibited from performing.

How are bonds traded?

Bonds are traded anywhere that a buyer and seller may be able to strike a deal. Unlike publicly traded stocks, bond trading does not have a central place or exchange. Rather, the bond market is an over-the-counter or OTC market without a formal exchange. However, some bond futures and options are traded on exchanges.

Bonds are traded thousands of times a day and these transactions play an important role in global economic markets. Consider the following; when buyers and sellers trade bonds, they are effectively dictating the yields on various bonds – this in turn, sets the price of credit in the economy. The yields in the bond market help to determine the interest rates on consumer loans, mortgages, car loans and GICs.

Bonds Vs Stocks

Trading bonds is lower profile than trading stocks but is arguably more important. Bond investors and dealers adjust their portfolios in accordance to the changing market conditions to maximise their returns. This is also true of stock investors, but the overall effect of the bond market activity is the prevailing level of interest rates in an economy – which affects all areas of credit, lending and borrowing.

Shareholders vs. Bondholders

What does it mean to hold either title? For a start, shareholders have very different rights compared to bondholders. Shareholders are effectively part owners of a company. Meaning, they get a say in how a company is run. Bondholders, as lenders, have no say whatsoever in the running and operating of a business or organisation.

However, in the case of a company liquidating, bondholders have the upper hand since their investment receives priority over shareholders investments. Bondholders’ investments are legally protected whereas shareholders have to rely on the financial strength of the company to receive their dividends.

Owning stocks in a company grants rights to shareholders to participate in company affairs. They have access to all company records, can attend annual meetings about performance, participate in electing directors, sue the company for infringing behaviour and of course, receive a cut of all declared dividends. There simply is no equivalent package of rights for bondholders.

Bankruptcy and Liquidation

When companies have to close down or reorganise, they’ll find themselves beginning the process of liquidation. In other words, they will sell off assets to pay for their debts. Debts, as opposed to dividends, are always paid off first – so bondholders have the advantage here. Shareholders will receive any money that is left over after all debt is repaid, which in some cases is none at all. This is one of the reasons bonds are considered safer investments.

Similarities and differences: All you need to know

Both investment ‘vehicles’ are used by companies and organisations to raise capital. Aside from the above-mentioned characteristics, how are they similar, in what ways are they different and which is the right investment asset class for you?

Stocks and Bonds: Differences Explained

- Bonds tend to be lower-risk and lower-return compared to riskier stocks which can provide high and long-term returns.

- Stocks represent ownership in a company while bonds represent debt.

- Bondholders have no voting rights in a company or organisation to which they invest in and stocks provide the owner with voting and participant rights.

- Typically all bonds pay regular interest, while not all stocks pay a dividend. In other words, bond interest is guaranteed – dividends are not.

- Most stocks are traded on a stock exchange while bonds are typically traded over the counter.

- In the event where a company goes bankrupt, bondholders have a higher claim on the company’s assets and are most likely to get some of their money back. Shareholders must wait until the company repays its debt before they receive their share from the money left over.

Should you invest in stocks or bonds?

Most investors, either advised to do so or off their own backs will diversify their portfolio and invest in both stocks and bonds. It’s important to think about your own appetite for risk and whether you have the funds to make long term and serious investments in bonds, for example. Stocks are appealing to investors since they can easily be traded under the right market conditions.

Another option would be to invest in preferred stocks as opposed to common stocks since they are effectively a hybrid between stocks and bonds. They typically pay higher dividends and are less volatile than common stocks. However, they come without voting rights and the preferred stock price very rarely increases with accordance to company growth. They do, however, provide preferred stock owners with a higher claim on the company’s assets than common stock shareholders in the case of bankruptcy.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)