The basic premise of any investment strategy is to make money. And how do investors make money out of shares? Most typically, by selling the shares for more than they bought them for. In doing so, they generate a ‘capital gain’. But just as all roads lead to Rome, there’s more than one way to make money from shares.

Many people idolise the thought of living off the passive income generated by dividend checks delivered by post. And it’s completely possible as long as you understand the ins and outs of dividend stock types, how they work and where to find the best ones.

Dividends are an incremental component to an investors portfolio. In fact, research shows that since 1925, half of the return an investor would have made from the S&P 500 market would have come from reinvesting dividend income into shares. Dividends, therefore, work as a catalyst for long-term capital appreciation.

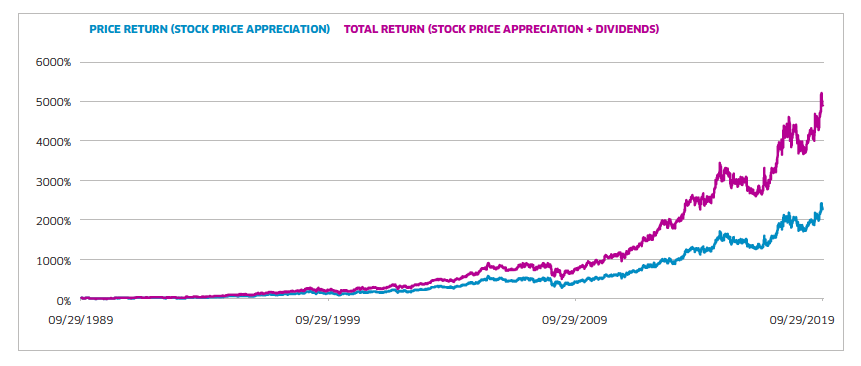

(Dividend growth during 1989 – 2019. Image: NASDAQ)

The total return on dividends is accelerating – giving investors vast options for reinvestment or retention as an additional stream of income. With that said, how exactly do dividends work? What are the types of dividends? Why do people invest in dividends, and why do companies pay out?

Types of dividends

A dividend is commonly believed to be a cash payment made to the holders of a company’s stock. There are quite a few types, however – not all of which involve the direct payment of cash to shareholders.

Cash dividends are the most commonly used. On the date of declaration, the company’s board of directors resolves to pay the provided dividend amount in cash to investors holding the company’s stock. On the date of record, dividends are assigned to shareholders who can expect to receive the cash on the date of payment.

Stock dividends are issued by the company in the form of shares. Rather than issue cash, the company uses the percentage of cash to provide additional shares to the shareholders up to the value of the dividend. The value of these additional shares is based on their current market value.

Property dividends are issued as a non-monetary, non-stock dividend to investors. A property dividend commonly includes shares of a subsidiary company or the physical assets owned by the company such as real estate and equipment.

Scrip dividends are issued when a company does not have sufficient funds to issue dividends at that moment. So, the company issues what is essentially a promissory note to pay shareholders at a later date.

Liquidating dividends may be allocated when the board of directors of a company deduced to return the capital initially contributed by investors as a dividend. It may indicate the closure of the business.

What are dividend stocks?

A dividend is a share of a company’s profits given to shareholders and is typically paid out quarterly – almost like a ‘bonus’ to investors. In many ways, they enable shareholders to participate in the growth of the company that goes beyond share price’s appreciation.

A company that agrees to ‘share its wealth’ with its investors can do so in two ways: cash dividends or stock dividends. Most people are familiar with cash dividends to some extent. They are essentially cash payments made on a per-share basis to the shareholders. For example, if a company pays a dividend of 20 pence per share, an investor with 200 shares would receive £40 in cash.

Stock dividends, on the other hand, are percentage increases in the number of shares owned. Simply, if an investor owns 100 shares in a company issuing a 10% stock dividend, the investor will then have 110 shares in the company.

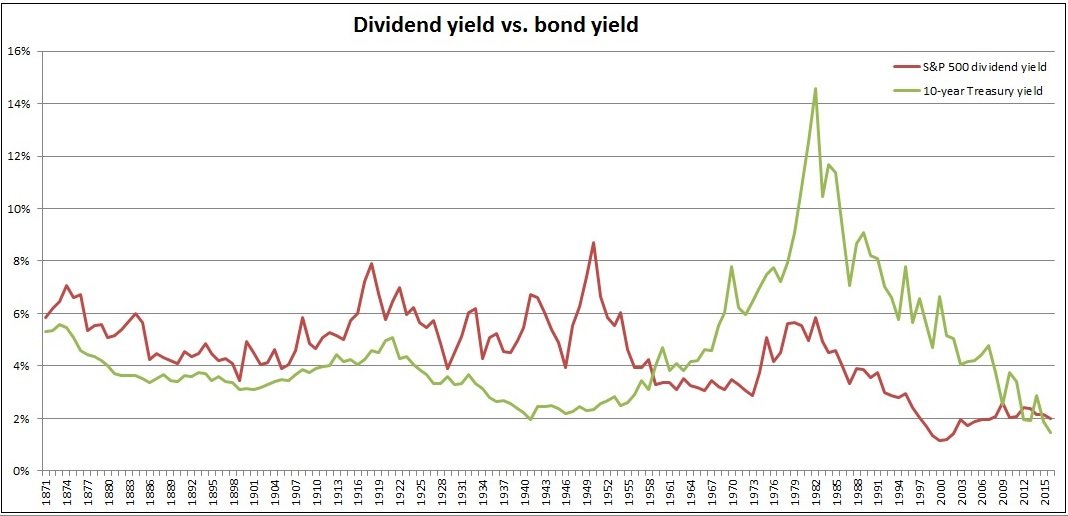

(Dividend yield versus bond yield. Image: BigTrends)

The underlying premise of dividends is remarkably close to that of bonds. Where they differ, however, is dividends are not guaranteed. Rather, they are at the discretion of the board of directors. Bonds must be paid otherwise be in default. Dividends can be reduced or eliminated at any time by the board of directors.

How do stock dividends work?

The process is simple. When a company pays dividends, the broker company or the dividend-paying company itself uses the cash to buy more shares of the underlying investment. The process can be completely automated should the investor wish. All they have to do is sign up for a dividend reinvestment program (DRIP).

As a result, the investor will end up with more shares of the company based on the current market rate. Stock dividends – that is, the distributed percentage increase in the number of shares of stock an investor owns, is known as dividends reinvestment. It’s commonly offered as a dividend reinvestment plan (DRIP) option by companies and mutual funds. It should be noted that dividends are regarded as taxable income – regardless of the form they take.

A DRIP offers a number of advantages to investors and it’s clear to see why it’s so appealing. The plan essentially allows investors to add to their current equity holdings using any additional funds from dividend payments. It is an automatic process – meaning, investors do not need to wait to receive dividend payments in cash in order to buy additional shares in the company.

Since company-operated DRIPs are usually commission-free as they are omitting a broker, the plan attracts a wide range of willing investors. Commission fees are disproportionately larger for smaller purchases of stock – meaning investors can comfortably access more shares.

Why people invest in dividends and why companies pay out

Of the many reasons investors prefer dividend-paying stocks, the most compelling is because stock dividends have been historically more stable than stock prices. Buying and selling shares of stock is risky. From volatile prices to market conditions, it’s difficult to know which to purchase and when to offload.

Dividend-paying stocks, on the other hand, are more stable, easier to manage and have a history of high returns potential. In 2008, for instance, the S&P 500 fell by 37% (Reuters) as confidence in corporate earnings declined following the financial crash. Stock prices, of course, plummeted but dividends paid out by S&P 500 companies actually increased.

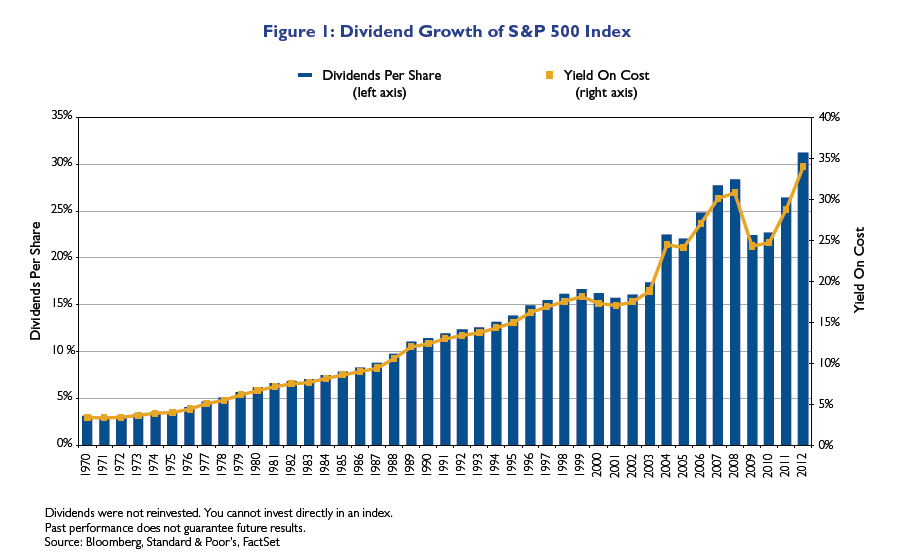

(Dividend growth of S&P 500 from 1972 – 2012. Image: Top Foreign Stocks)

Eventually, in 2009, S&P 500 companies had decreased their dividends in light of the recession. However, they’d only fallen by 20% and by the following year, had begun to increase again. What’s more, by 2011, dividends had reached record highs while stock prices only reached a new high in 2012.

Along with the security and stability of dividend repayments, there are some diverse reasons as to why investors prefer companies that pay out and share their wealth.

1. Income potential

The number one reason to pursue an investment is to make money – people buy stocks to make capital gains on the rising value of stock prices over time. Dividend-paying stocks are unique in that they offer the best of both worlds. There is the potential for capital gains in addition to receiving regular income from dividends. Investors don’t need to make difficult decisions on selling stocks to fund retirement spending – as their portfolio is already making money.

2. Discounted shares

Some companies offer investors the opportunity to purchase additional shares in cash at a discount. This can have a massive impact on the performance of their portfolio as discounts from 1% – 10% combined with no commission fees associated with DRIPs, investors can acquire additional stock holdings at a better rate than those who purchase shares in cash through a broker.

3. Earnings quality

Companies that pay dividends tend to have a better and more robust business model- as well as higher quality earnings. There’s a reason why not all businesses pay dividends – It’s hard to pay and sustain a regular dividend every quarter. Investors can be sure of the capabilities of the dividend-paying companies they invest in.

4. Less volatility

Stocks that pay dividends are far less volatile than those that don’t. The difference between dividend-paying stocks and non-dividend paying stocks is that the highs and lows are smaller in velocity. They pay higher returns on average and are more stable than standard stocks. Thereby, reducing risk and allowing for a healthier, more stable investment portfolio.

5. Disciplined decision-making

The idea here is that companies that promise their shareholder’s regular bonuses in cash or stock payments are less likely to make unforced mistakes like acquiring competitors at high prices, or throwing shareholders cash at projects with low or questionable returns. Hence, share value is likely to remain high should investors wish to see some capital gains.

6. Favourable taxes

Dividend income is generally given preferable tax treatment. In the UK, you do not pay tax on any dividend income that falls within your Personal Allowance – that is the amount of income you can earn in a year without paying tax. UK residents also get a dividend allowance on which they are taxed on the income that goes above it.

The U.S. tax code typically taxes dividend income at the long term capital gains tax rate, which tops out at 23.8% for the highest income earners. For perspective, income on interest-paying investments is taxes as high at 37% at the federal level. Therefore, for most Americans, it’s better – tax-wise – to earn each dollar from dividends than from interest or labour.

Why do some businesses pay out?

The compelling reasons for investors to buy into dividend-paying companies is clear. But what’s in it for businesses and why do some companies prefer to distribute their hard-earned profits with their shareholders?

The first reason comes down to the fact that companies who pay dividends, as we know, are incredibly attractive to investors at all levels. Paying dividends is a great way to attract investment and can help generate massive amounts of money to fund new projects.

Each company hopes the pay off on their own investments will be higher than their initial cost. Organisations with strong business models will achieve this goal and could potentially earn more than it actually needs. What happens then?

Apple is a good example of a highly profitable company that in fact earns far more than it could reasonably need to reinvest back into the business. Consider this; in 2017, Apple spent over $11.5 billion on research and development having earnt over $48 billion the same year. Apple simply makes too much money to find a productive use for it.

In short, a company that eventually runs out of reasonable ways to reinvest its earnings are prompted to pay dividends to its shareholders – who would rather receive dividends than watch their money disappear on futile projects.

Why should you reinvest dividends?

There are quite a few reasons as to why an investor might choose to reinvest their dividends:

- Allows the purchase of fractional shares

- Usually commission-free

- Puts cash to work quickly

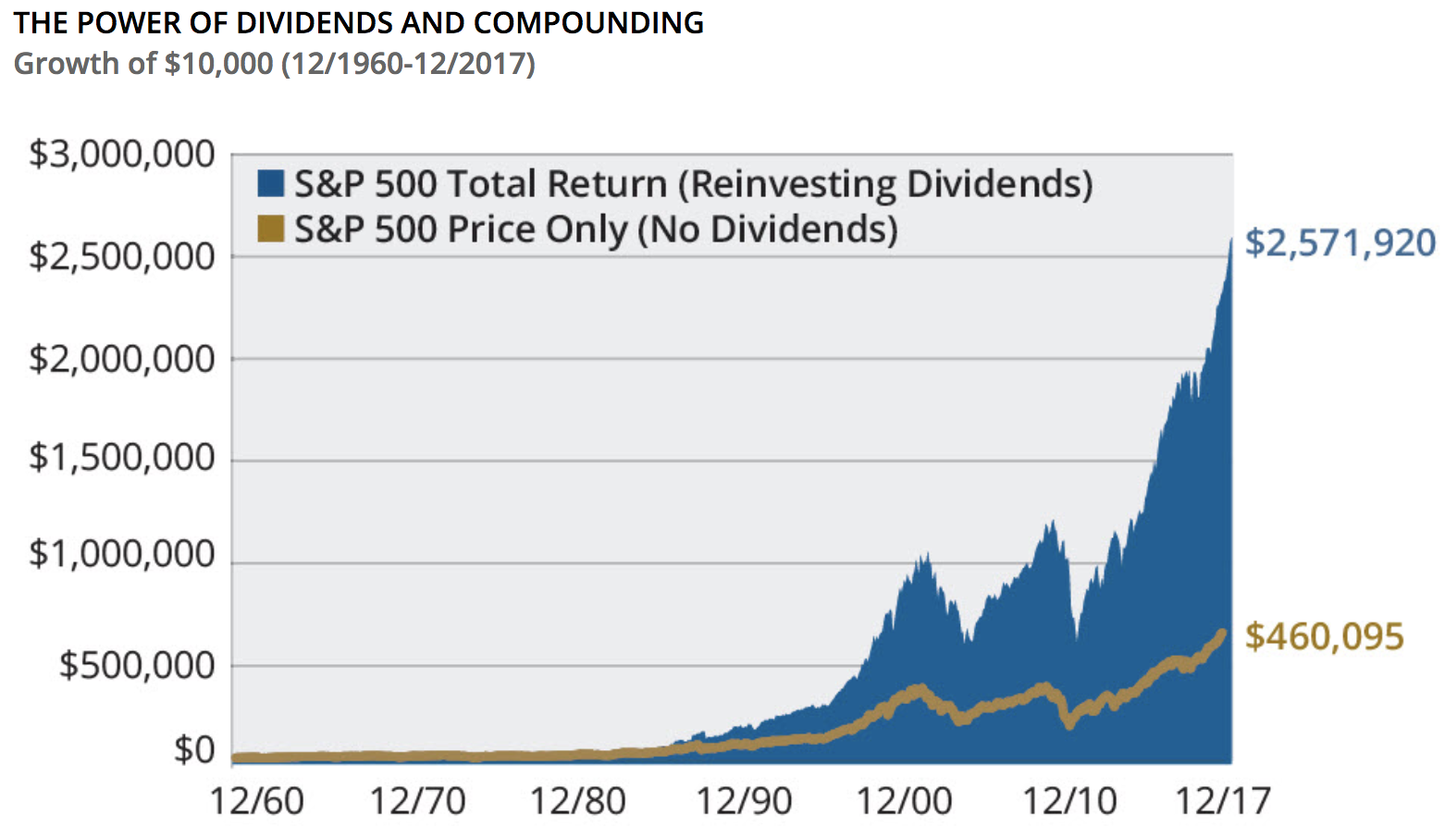

But without a doubt, the best reason to consider automating dividend reinvestment is to benefit from compounding interest. The idea behind this is that the returns a hypothetical inverter could have earned in the S&P 500 with dividend reinvestment are vast. If in 1970 an investor put $10,000 into an S&P index fund, they would have more than $350,000 by the end of 2019 – a figure generated assuming no dividends (Morningstar and Hartford Funds).

However, when dividends are added to the same investment over the same period of time, the investor would have well over $1.6 million by 2019. In light of this extraordinarily high return potential, investors should indeed consider automatically reinvesting their dividends.

(Illustrating the returns on reinvesting dividends in the S&P 500. Image: SimplySafeDividends)

Of course, there are instances where it would be less preferred to do so. For example, should the investor need cash to cover expenses, or have specifically planned to use the money to make other investments and finally, if they don’t want to increase their allocation to a particular organisation or fund.

How to find the best dividend stocks

Investing in dividend stocks is a tried and tested strategy of wealth accumulation that offers protection against inflation in ways some bonds simply cannot. Since the first-ever dividend paid in 1780, investors from all over the world can agree on a few dividend-investing strategies. Let’s look at a few important factors to keep in mind on your search for the best dividend stocks for you.

-

Steady growth

Long term growth and profitability is a key consideration when vetting dividend-paying companies. Keep in mind that it’s possible for any company to experience a profitable quarter, but only companies who demonstrate consistent growth on an annual basis should make the portfolio cut.

As a general rule of thumb, investors should seek out companies whose long term growth expectations in terms of earnings are between 5% and 15%. Anything above this range could lead to disappointment as goals are not reached – which damages the stock price.

-

Healthy cash flow

Dividend-paying companies need to be in a position where they are able to generate enough cash to indeed payout. Investors should aim to find companies with healthy cash flow generation, therefore.

-

Dividend growth

Investors should be able to look back on previous dividend records. A minimal five-year track record of strong dividend payouts should suffice and signal continued dividend growth. Timing is, of course, critical for investors too and they’ll want to purchase their shares before the ex-dividend date to ensure they get a payment.

-

Healthy debt to equity ratio

Investors should steer clear of debt by avoiding companies that are saddled excessively. This is because businesses with debt tend to channel their funds to paying off their debt rather than committing to paying capital to their dividend programs. Investors should therefore examine a company’s debt to equity ratio and identify those below 2.00.

-

Industry trends

Clearly, it’s important to keep an eye on a company’s internal figures to determine its capability of providing decent dividends. But it’s no less essential to look within the broader sector to cultivate a more holistic view of future performance.

For example, an oil company may be thriving in today’s climate, strong enough to commit to an attractive dividend program; but a plunge in oil prices is likely to spike demand and decrease supply. This should technically result in stock price depreciation and have an adverse effect on dividend payouts.

As an example of identifying and capitalising on opportunities, look no further than the ageing baby boomer population. They are expected to cause a sky-high demand in healthcare services over the next few decades. Whilst this by no means guarantees the performance of any particular healthcare provider – this general rising demand should be taken into consideration along with the fact healthcare stocks have historically been resilient to market plunges. This opens up the opportunity for steady dividend increases going forward.

Sector trends are important but be mindful of the fact that they can change at any given moment and not to put too much emphasis on external factors when sussing out dividend-paying companies. Just consider the soft drink industry, which historically has been a safe investment. Consumers are becoming increasingly concerned with health. Consequently, some beverage companies are moving into the healthier drink space. This shift will take time to establish itself – so investors should take care not to rush into investing their cash.

-

Evaluate the stock

Just as all investors should be weighing up the company itself as well as the external market conditions – such as consumer attitude – they should also look deeper into the stock itself. To get a real appreciation for a high-dividend stock, begin by comparing the dividend yields between alternatives. If the dividend yield is significantly higher than that of some similar companies, don’t get excited just yet as this could be a red flag, worth additional research.

Also, look at the stocks payout ratio as this tells you how much of the company’s income is going toward dividends. A payout ratio is generally considered to be too high when it’s above 80%. It simply means the company is putting too much of its income into paying dividends and suggests a weak cashflow. In some cases, dividend payout ratios can be more than 100% – sending the company back into debt to pay its shareholders.

Following these tips, investors should be able to identify companies that boast long-term expected earnings growth between 5% and 15%, with strong cash flows, debt to equity ratios below 2.00 and superior industrial strength.

Screening for dividend-paying stocks

You can screen for stocks that pay dividends on multiple financial sites as well as broker websites. Note that when screening for dividend stocks, higher-paying stocks can indeed be riskier. To be on the safe side, it is recommended that investors with a low appetite for risk stick with stocks with a dividend yield of 4% – 5%.

The Tradingview Stock Screener is a good place to start. It’s filters allow investors to define the criteria of their stock screen. For example, users can select all U.S. stocks priced at $15 or higher with a dividend yield of 8% and include ETFs should they wish to do so. Applying such filters reduces the number of optional stocks by thousands to make the selection process easier. The dividends tab found on most screeners also assesses dividend stocks based on performance, valuation and dividend yield.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)