The task of raising equity funding for your startup tends to be an arduous and stressful one. Placing the future of your endeavour in the hands of someone else is never easy, but if you successfully secure a windfall that’s right for you, it could be the first step towards making your dreams a reality.

(Image: Carocked)

Securing funding has a habit of taking founders by surprise more often than not. Startup owners typically underestimate the complexity of the process. This may not be surprising though – most entrepreneurs have lived and breathed their business for some time before seeking capital. To them, the whole concept is simple.

You may be convinced that your project will end up as a resounding success, but getting venture capital firms to agree can be another matter entirely.

Time really does mean money for startups, and waiting on decisions can be a costly process at such a delicate time in a company’s lifespan.

However, despite the long waits and potential negotiations over equity, thousands of startups successfully raise the funding they need every year. This shows that, although venture capital funding can be the source of stress for business owners, it remains one of the best options out there for scaling your business accordingly.

If you’re interested in raising capital for your endeavour, it’s important to know that funding comes in many stages. Let’s take a deeper look at the intricate form many venture capital funds take:

Pre-seed and seed funding

Before we tackle the startup funding series, it’s time to enter pre-seed and seed funding. These two processes are the earliest forms of business funding and often occur so early in a company’s lifecycle that they aren’t acknowledged as a formal stage of capital raising.

Naturally, pre-seed funding arrives first for businesses. At this stage, the onus is on founders to work on building some form of proof-of-concept or product prototype. Raising money to develop this is typically a task that the founders themselves need to work out on their own. At this stage, funding is most likely to arrive in the form of personal savings, family and friends, angel investors, incubators or crowdfunders.

Of course, the money needed at the pre-seed stage of funding will vary depending on the business or the type of products or services it’s planning on offering.

After pre-seed comes seed funding. This will likely be the first instance of funding that your company raises. The name is self-explanatory, but to ensure crystal clarity – the seed represents the early finance that promises to grow your company.

Much like the case of pre-seed funding, seed funding can be raised from an array of sources, like family and friends, as well as crowdfunders. However, at this stage, the most common form of investor tends to be angel investors.

Sadly, seed funding signifies the first potentially volatile stage in your startup’s development. Many businesses fail to find the funding that they need in order to progress beyond the seed stage. If they run out of money before being picked up by investors, it’s known in the industry as ‘running out of runway’.

Sometimes this process isn’t nearly as arduous as it appears, and businesses decide that there’s no need to raise any further money – thus deciding to scale without looking for more windfall and leaving the startup funding series at an early stage.

(Image: Medium)

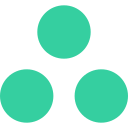

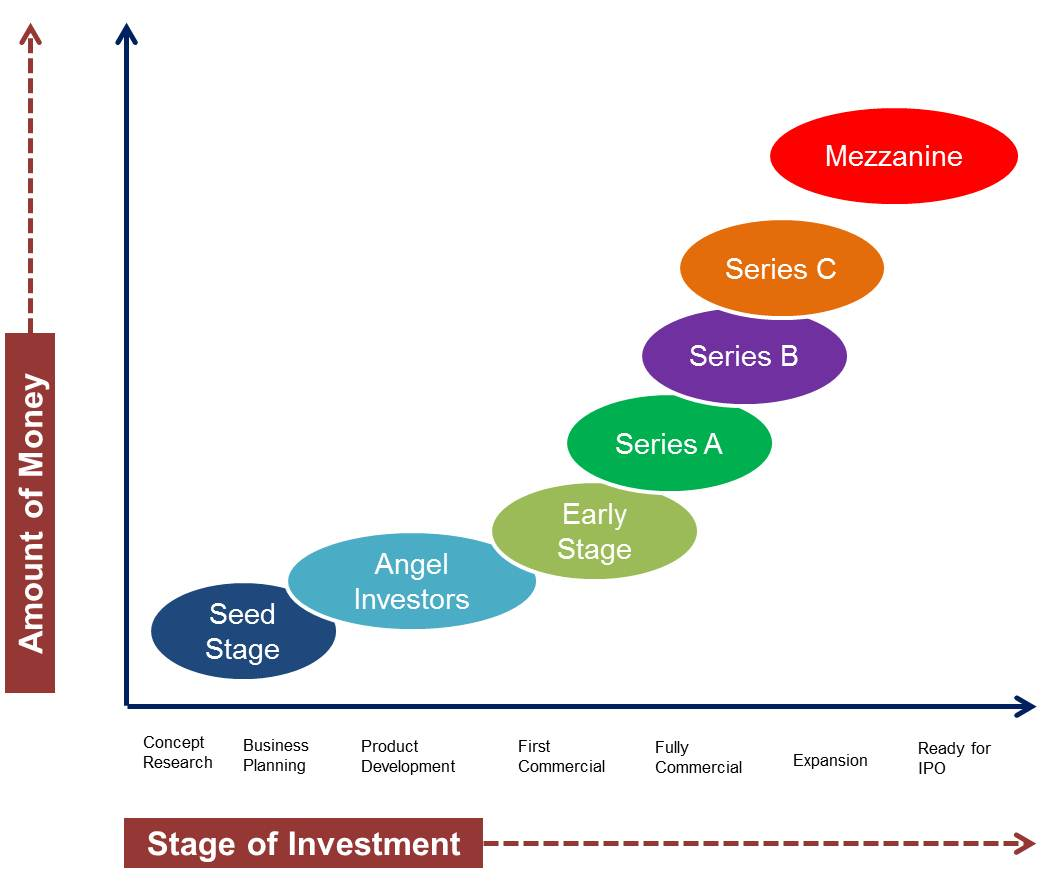

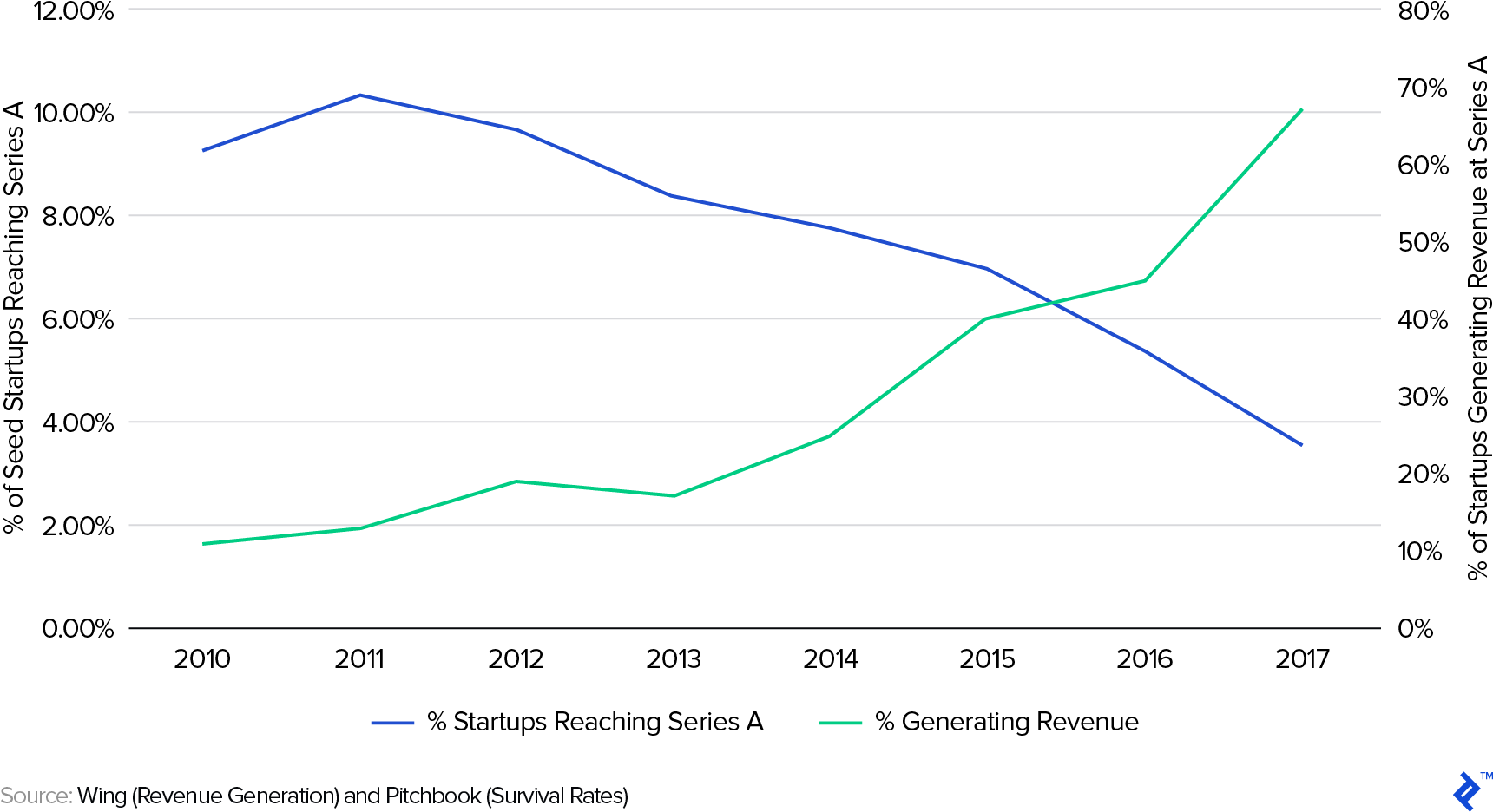

The chart above illustrates the key significances of a startup’s transition from seed funding towards the beginning of the funding series.

Typically, seed funding involved figures of between £500,000 and £2 million, but the figure can vary wildly depending on a startup’s industry and its ambitions.

As we can see, while the money involved in a pre-seed round is dwarfed by that of the eventual arrival of Series A, the rate that the business scales in the latter stages demands an effective allocation of resources early on. Concepts need to be refined and developed into working prototypes to generate the right indicators as to how the startup will fare when it embarks on funding Series A and beyond.

As we can see, the chart also introduces us to ‘Seed-Plus’. Also known as a Seed Extension, Seed-Plus rounds can come into play when a business is scaling but doesn’t yet see itself as ready to take the plunge and enter Series A of funding.

Spending more time in seed funding has become increasingly appealing to emerging businesses in recent years. This is because when a startup jumps to Series A, the ownership requirements of larger funds means that there’s less negotiating room to bring experienced and knowledgeable investors who could help to guide the company’s progression. This means that for most companies that are looking to use innovation as a USP, like in SaaS or Fintech industries, it could be more desirable to shift into a Seed-Plus state for a period of time before deciding to jump into Series A.

(Image: Toptal)

Finance experts, Toptal note that over the course of the previous decade the median size of Series A rose from around $3 million to $8 million. This growth correlated at .78 to the increase in time between seed and Series A rounds over the same period of time. These figures show that startups are choosing to become older before moving into Series A funding and transitioning into a scaling business.

Subsequently, the median age of a startup that’s still busy raising angel or seed funding has risen from approximately a year to 2.85 years. This shift has been partly facilitated by large investors who are willing to exercise patience in watching their investments develop.

Series A

After seed funding, it’s time to look to the Series A stage of funding. Series A begins when a startup builds some form of momentum following on from the seed stage of their business.

There should be clear evidence that the company is ready to go to the next level. This evidence can be based on established interest, early revenue or Key Performance Indicators that show there’s enough reason to continue in development.

The Series A round of investment tends to rely on startups having a plan for developing a functioning business model, even if it’s not yet been proven yet. At this stage, any windfall is expected to be converted into a credible revenue stream.

Series A is a pivotal part of a startup’s progression, and thus funds usually climb to between £2 million and £15 million. However, with higher windfalls comes the demand for more substance. Investors will be seeking out more tangible evidence than a founder simply having a good idea, and startup owners will need to prove that a good idea can be converted into a profitable business.

This stage in a company’s funding is usually driven by a single investor that orchestrates the whole of Series A. Finding that first investor is perhaps the single most important part of the financing of a new business – this is because once one commits to your startup, others tend to follow suit.

Likewise, losing your first investor can be a hammer blow, because there’s always a risk that others will pull the plug too.

Venture capital firms tend to bankroll Series A funding, but there could be some involvement from angel investors. Likewise, equity crowdfunders have risen in popularity over the previous five years.

(Image: Medium)

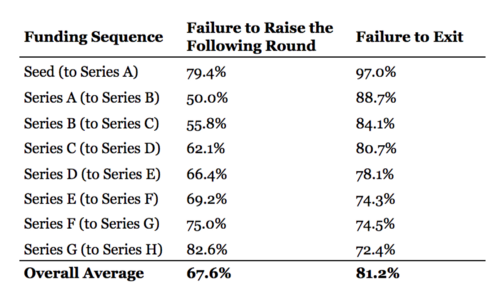

Interestingly, while startups will almost always find themselves in choppy waters throughout the funding process, arriving at Series A represents a significant step towards stability, with the typical progression rate from Series A to B startups sitting at a comparatively appealing 50%.

While making the transition from seed funding to Series A represents one of the biggest leaps of faith for a startup, once a willing investor is found and is ready to help you scale, the early Series could be seen as statistically less volatile than seed rounds.

However, with that said, Series A and B funding only represents the eye of the storm, with average startup failure rates leaping with every subsequent stage your business embarks on. By the time you arrive at the latter series of investment, your chances of progression fall to just 17.4%. The good news is that with the right level of investment and scaling, your business should be up and running and progressing fast enough to bypass those difficult latter stages of investment to enter the world as a fully-fledged scaled business.

Series B

When your startup has successfully found a place for their product in the market and you’re confident enough to expand, it’s time to begin the process of raising a Series B round of funding.

Series B is all about scalability. You need to have enough evidence that you can expand your client or customer base from 200 to 2,000, or 200,000.

This is also the time for you to consider boosting the number of workers to aid your proportions for scaling. Series B will signal the beginning of your transition from an establishing company into a competitive force in the industry. You’ll need resources to strengthen your workforce and exposure to new customers.

This will call for the recruitment of talented individuals to help with your strategies, and more investments will be focussed towards the wage bill of skilled staff.

The level of investment brought in by Series B funding typically ranges from £7 million to £10 million, and by now companies can expect valuations of between £30 million and £60 million.

Due to the significant figures associated with this funding stage, the task of investing is usually undertaken by venture capital firms. Each series arrives alongside a fresh valuation for a startup, so most investors tend to reinvest to ensure their stake stays strong.

Some venture capital firms operate solely to help late-stage startups, and if you’re looking for a little extra windfall, it could be worth seeking them out.

Series C

If your startup makes it to the Series C phase of fundraising, it’s fair to say that you’re performing very well and are ready to tap into fresh markets or start work on developing new products and services.

It’s common for Series C businesses to start expanding internationally and reach wider audiences. It’s also possible that they’re seeking a chance to build on their company value before going for an Initial Public Offering (IPO).

Series C is often regarded as the final round of fundraising that a business engages in, but it’s not uncommon for some companies to move on to Series D and even E.

According to Tech.co, the average sum raised by businesses during the Series C stage of fundraising stands at around $26 million – approximately £20 million.

(Image: Funding Box)

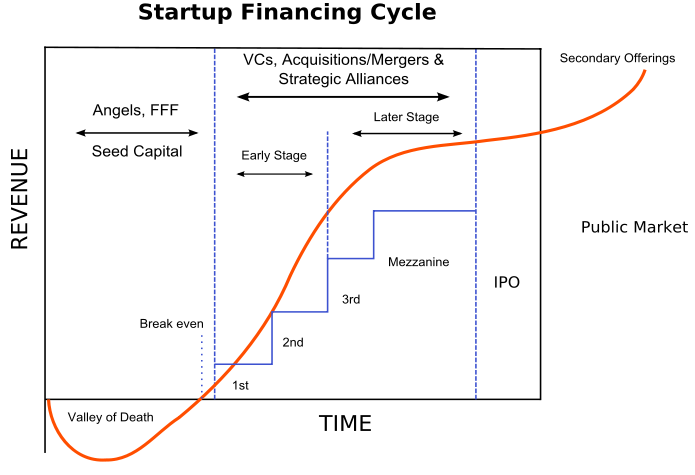

According to the graph above, startup funding Series C indicates a significant transition from the seed funding ‘Valley of Death’ stage of a business’ progression towards a reliable stream of profit and the latter stages of their VC lifecycle.

By this stage, you may be ready to launch an IPO, or fully immerse yourself into the market. However, moving into Series D of fundraising isn’t necessarily a bag thing and entering subsequent funding stages can work wonders in ensuring that you’re developing a more sustainable business model that’s better placed to create steady profits.

Series D

Not all businesses choose to move on to the Series D stage of fundraising, with many establishing themselves by this point in a way where they’re comfortable in generating their own revenue streams for further expansion. However, there are a few very valid reasons as to why Series D investment may be required.

Firstly, the move could be down to you finding a new means of expansion before angling for an IPO. This extra level of expansion could prove a vital stepping stone before you take the leap of faith into going public.

It’s also possible that your company simply wanted to stay private for a little longer before making the switch towards an IPO.

Another more concerning reason could be down to your business failing to meet its expectations from Series C. Known as a ‘down round’, this scenario would require Series D to act as a safety net in helping to ensure the company’s future isn’t negatively affected by poor returns on investment.

While early rounds tend to run up consistent figures as far as investment is concerned, it’s trickier to pinpoint the level of funding acquired in Series D, because of the various circumstances involved. When entering Series D of funding, it’s important for founders and decision-makers to take a long look at business performance and the plans in place, and cost up the required figures accordingly.

Series E

Series E is a fundraising round that acts very similarly to that of D. Perhaps you’ve missed your previous targets, or maybe you’ve wanted to remain private further into the future?

Either way, it’s very rare to see companies progress to the Series E stage of investment, and founders usually make the move due to an unforeseen circumstance that wasn’t accounted for in earlier business plans.

This isn’t to say that moving into Series E is a bad thing, and it could prove highly lucrative for your future profit margins.

Once again, the level of finance raised at this stage is highly subjective, and dependant on too many variables to quantify. But Remember, at all phases of your startup’s life, make sure you keep a level head and approach your plans with a critical eye – and there’s no reason why each stage of your fundraising rounds can’t be a resounding success.

Series F, G, H and Beyond

As we touched on in Series E of funding, it’s possible for your startup to not quite see itself as prepared for an IPO or fully immersing itself into the market and subsequently choosing to engage in more rounds of funding.

In the wake of the COVID-19 pandemic, more businesses have been entering the latter stages of funding to ensure that they survive without having to suffer heavy losses due to a lack of productivity or consumer power.

Some startups have found great success from these late stages of funding. Notably, Couchbase managed to generate over $105 million in a bid to enter the global markets with a better state of preparation despite COVID.

While the latter series of fundraising may feel like a level of failure for your startup, it’s important to remember that every business is different and some endeavours can comfortably enter new rounds of funding for a variety of reasons that don’t signify that failure’s inevitable.

Mezzanine Financing

(Image: PrimeFund)

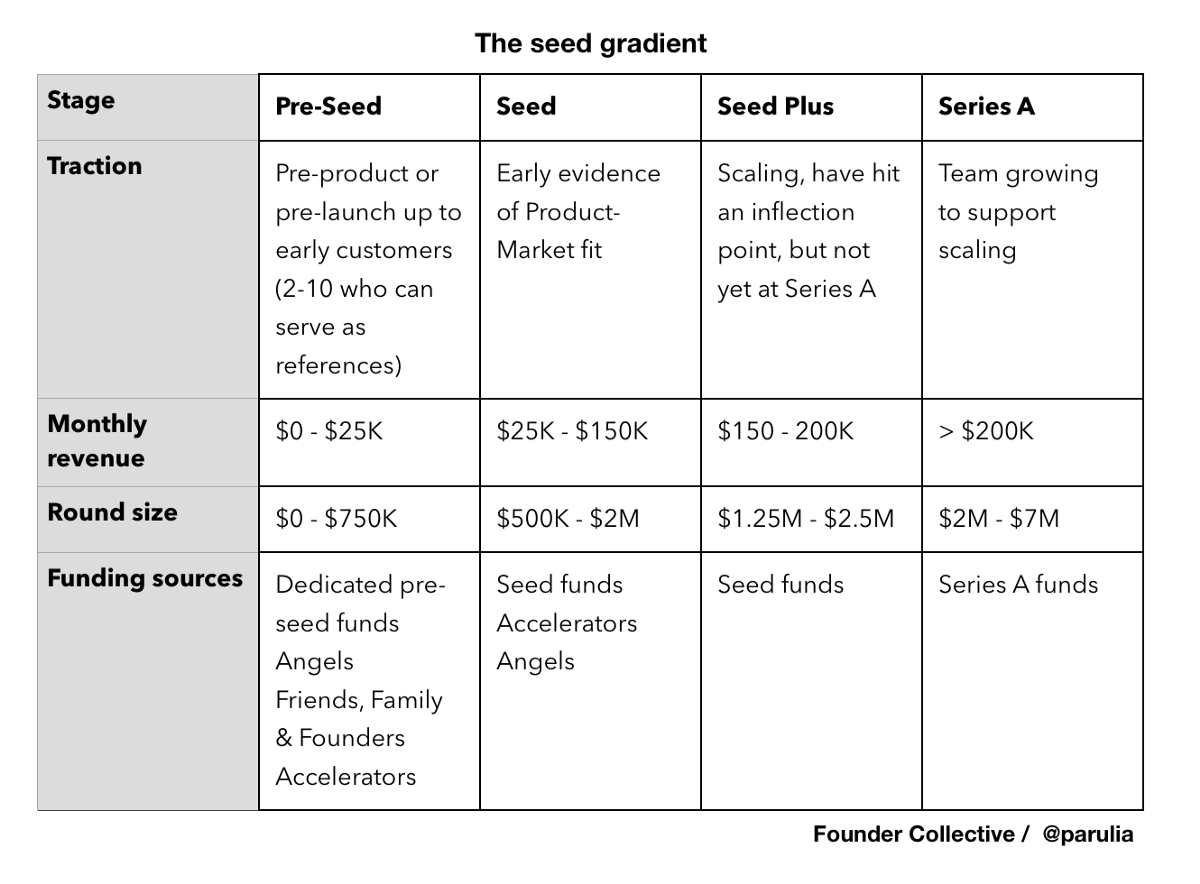

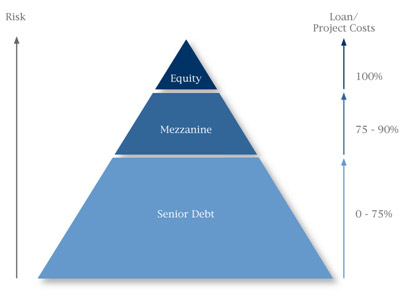

Our ultimate guide to startup funding wouldn’t be complete without clarifying Mezzanine Financing and what it signifies.

Entering the fray with something of an unusual name, Mezzanine finance sits between debt and equity finance. While it can be highly complicated at times, Mezzanine Finance can represent a lifeline for businesses in different funding scenarios, and the approach could offer an alternative option to be utilised alongside a standard loan, equity fundraising or both together.

Mezzanine represents the third way. Where lending mechanics can vary wildly depending on business structures and approaches to fundraising, the general idea is that a startup combines elements of risk and reward in the equity investments that they take on – combined with more predictable income from loans over the shorter term.

One more popular arrangement comes in the form of a loan that can convert into an equity share after a pre-determined amount of time elapses – or at the discretion of the lender in question. This means that if your startup scales accordingly, the business can pay back the money of its own accord, but if things don’t quite go to plan, the lender can recover costs in the form of company shares that are likely to increase in value.

Other scenarios can position Mezzanine Funding as shares in a startup as a form of collateral for loans. This means that the future growth of the business allows it to borrow more than what would otherwise be possible from a senior debt with a regular lender.

Mezzanine Finance should be looked upon as a viable ‘top up’ funding option for big projects. For instance, if you were aiming to raise upwards of £10 million, and you’ve agreed a loan of £7.5m with a standard lender. By turning to a Mezzanine agreement, you could secure an extra £1.5 million, meaning that you could only have to find an extra £1 million yourself to add into the mix.

Alternatively, you could still add in the required £2.5 million but enjoy having a project fund of £11.5 million instead of £10m.

In this respect, Mezzanine Finance allows users to leverage their future profits in the short term for a maximum return with the cash contributions that are available.