Embarking on a startup journey gives you the power to make something out of nothing. Perhaps it’s fair to say that whether your startup shakes its industry to the core or fails miserably – it will all be worth it. Perhaps it isn’t. If your cost-benefit analysis conclusively determines that what you put into the startup grind is disproportionately more than what you take out, you’ll probably find it wasn’t worth it after all.

At least you won’t be alone. In fact, over 90% of startup owners eventually come to the harrowing realisation that the use of their time, money and energy was all in vain. But before you fail, you’ll have to face the startup grind, overcome continuous obstacles and rise to the challenge of launching a successful startup.

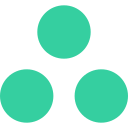

Biggest obstacles Millennials faced in creating their own business in 2018

(Responses for the biggest obstacles faced when starting a new business. Image: Statista)

The first part of the startup-hustle is to break down the initial barriers to launching a new business. For 38% of millennials in 2018, finding access to funding was the main obstacle to their startup vision. The grind starts when you begin raising capital for your startup. For those struggling to come up with a lucrative idea to be implemented into a business plan; the grind begins at the drawing board. It takes hours of market research, creativity and self-motivation to find your place in the market.

What’s the Startup Grind?

Whichever industry, whatever your budget and wherever you are; you’ll have to put in the work to have a chance to get into the small and exclusive club of successful startups. The startup grind starts now and it will take its toll on your time, energy and resources. Most importantly, it will test your self-motivation – the key quality of a successful entrepreneur.

Time

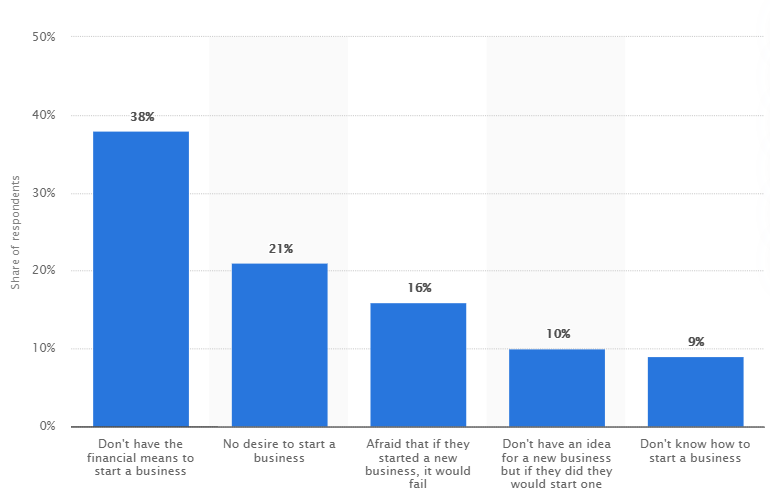

Most startups will go through a similar and fairly predictable ‘startup phase’. At first, the expenses will exceed revenue and losses are inevitable. After all, you’ll have to put something in to generate a return. As revenue increases, a startup will reach a break-even point – where revenue is effectively equal to expenses. The startup cannot yet be said to be profitable but is successful. As the revenue exceeds expenses and the business becomes profitable, you’re finally at a quantifiable position of success.

(Image: PlanProjections)

The diagram illustrates these three phases and demonstrates that this business will break even at around the 3-year mark. It’s estimated that startups on average take 2-3 years to reach this point. Up until the point of profitability; perseverance, money management and effectively, time, should be poured in abundance into the startup.

Opportunity Cost

This is a fundamental component of the startup grind and one which is stored in the minds of all entrepreneurs until they reach the point of profitability – if not forever. It effectively takes into account the loss of other alternatives when one alternative is chosen. All entrepreneurs must carry the burden of their decision to take on one startup venture and abandon other opportunities.

Most entrepreneurs embarking on their startup journey will have made the decision to abandon other business ideas. The ‘what ifs’ will creep up on you during times of success and of failure, despite your self-assurance and motivation. The startup grid becomes twice as hard as you strive to prove to yourself and others that you made the right decision.

Finding Capital

We’ve all heard it, “money doesn’t grow on trees”. You have to work for it and the same is true when it comes to finding money to finance your startup. Fortunately, you’ll have a few options when it comes to raising capital for your startup – each demanding different levels of the grind.

Bootstrap your way to entrepreneurial success by resourcefully using your own funds to finance your business idea. This is perhaps one of the most rewarding funding options – as such, it’s one of the most challenging and demanding.

Equally, finding an inventor takes time, energy and a particular set of entrepreneurial qualities. Once found, you’ll have to work twice as hard to meet the demands and expectations of your investor, the pressure increases when you have to hit targets – particularly if you are anticipating a further round of fundraising.

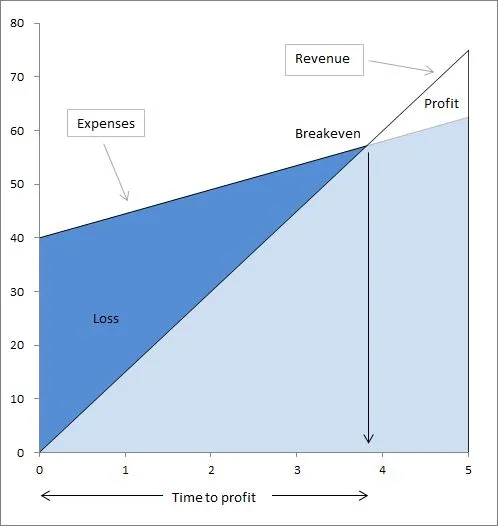

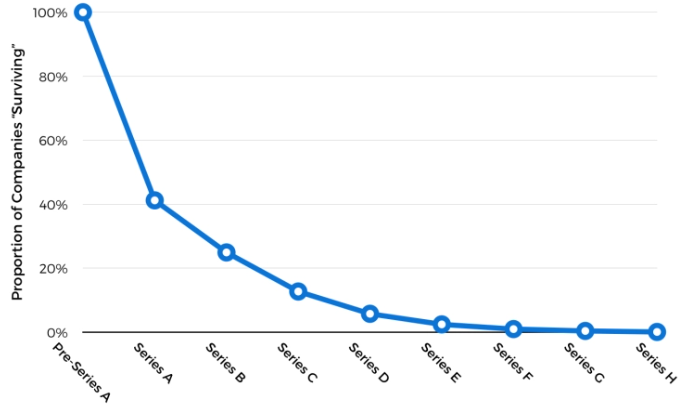

(Image: TechCrunch)

The grind is no less of a burden for those startups that find themselves raising further rounds of capital. The startup survival curve in the graph above illustrates the proportion of companies surviving each round of funding. It’s apparent that startup companies between seed and Series A funding should be cautious of being swept into failure.

What’s a Startup Risk?

One of the most obvious risks of starting a business is that it fails to ever become profitable. We know that the time between expenses exceeding revenue, and hitting the break-even point can be on average, 3 years. It often takes longer, and in most cases, breaking even is never achieved.

Part of starting a business is accumulating debt. The risk is letting it consume you and your business. There are a few ways to manage your startup debt, including:

- Staying organised

- Reviewing cash flow

- Cutting costs

- Increasing revenue

- Establishing a sound payment plan

Combined with the risk of failure and accumulation of debt, comes a plethora of other disheartening, adverse reactions to these losses. Feelings of resentment and regret are all part of the risk of starting a business.

Cost-benefit analysis

The ultimate consideration before starting a business is ‘is it worth it? Cost-Benefit Analysis (CBA) is a technique used by companies to arrive at the decision as to whether it’s all worth it. Working out the costs and benefits of your startup with the help of different models, formulas and online tools can help you determine whether the startup grind is worth it.

Simply calculate: Total costs of the project ÷ anticipated returns

If your anticipated returns are more than your projected costs, the ratio is positive. However, this formula is subject to many variables such as inflation and your ability to forecast projected costs and returns effectively. Yet the premise remains the same. If you can ground for forecasts in logic and probability, your calculations should represent a reliable estimate of the risk posed.

Alternatively, turn to online tools to establish a more sophisticated Cost-Benefit Analysis.

Getting past the startup hurdles of finding time, capital and coming to terms with your opportunity cost is only the beginning of the grind. Working tirelessly for years to break-even is often followed by years of maintenance, growth and funding rounds. All of which, massively dampen the romantic illusion of starting a business.

However, a successful startup that has been enthusiastically welcomed by the market; is put in a strong position to find easy access to finance and expansion capabilities. For these companies, the grind, hustle, opportunity cost and emotional exhaustion are all worth it.