The process of calculating the value of a company differs depending on the stage of the business. It’s an important process in any case since it determines levels of investment, growth opportunities and the ability to forecast for the future.

Business owners will naturally hope for a high valuation. Pre-revenue investors, in turn, typically prefer a lower value that promises a bigger return on their investment. When it comes to valuing a startup, there is a balance to be found.

When it comes to startup valuation, specific methods of calculation are vital – since they are typically applied to companies that are at a pre-revenue stage, as opposed to established, money-making machines. One might wonder how a monetary value can be allocated to a non-money-making entity. However, there are quite a few ways to value a startup no matter where it’s at on its startup journey.

What you need to know about startup valuation:

- It’s an important measurement for those who are trying to raise capital for their startups, or those who are looking for investment opportunities.

- Startups who turn to angel investors, VCs and individuals for capital to get their startups off the ground have to be able to demonstrate the value of the startup today, next year, in 10 years time and every period in between so ROI can be projected accordingly.

- Startups are notoriously hard to value since they don’t yet have operating revenue or in some cases, a salable product. In fact, many are still in the spending phase of building a business.

- There are a number of valuation methods specifically designed for startups.

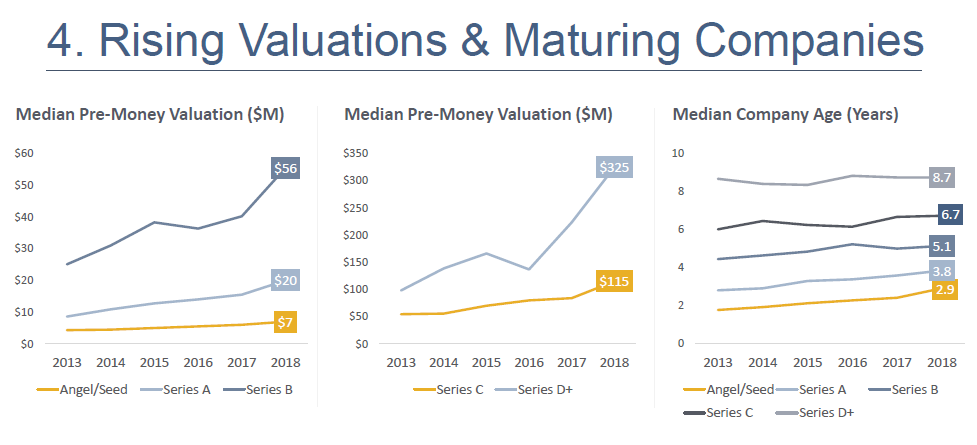

(Startup valuations and maturing companies. Image: Source)

The graphs above demonstrate an upward trend of startup valuations as the company matures. We can see that the median valuation of Series A deals has doubled since 2013 to $20m. Series B valuations had effectively tripled by 2018 at $56m. Startup valuations, therefore, are largely dependent on the stage of the venture.

Startup valuation Vs. Mature business valuation

Startups lack data, experience, a degree of customer loyalty and past financial records. But many make up for it with their drive and ambition to succeed. Unlike startups, a mature publicly-listed business, for example, will have the hard facts and figures backed by a steady stream of revenue and financial records to make valuations a lot easier.

Earnings before interest, taxes, depreciation and amortization (EBITDA) is calculated to value a mature business as follows:

EBITDA = Net profit + Interest + Taxes + Depreciation + Amortization

For startups with little revenue or profits, combined with less-than-certain futures, assigning a valuation is challenging. These figures aren’t available to most startups, meaning assigning its valuation is challenging – but by using other metrics – not impossible.

Key factors to consider when valuing a pre-revenue startup

Before we begin to explore the number of ways a startup can be effectively valued, it pays to understand some of the factors that will play central roles in replacing hard-facts in the valuation process.

1. Traction

Most startups will have a small fire going and investors will want to add fuel to it. Traction is essentially proof of concept. It can be measured in terms of the number of users or customers a startup already has – the more the better.

Effectiveness of marketing is also key. If a startup can show that they attract high-value customers through a relatively low acquisition cost, they’ll also attract the attention of pre-revenue investors.

Finally, the growth rate – which has no predetermined scale. A startup that has grown even slightly on a small budget is an indication to investors that it will grow further with financial backing.

2. Value of the team

The fact is, investors will be just as interested in the concept of the startup as they are the people behind it. A high-value team, and hence high-value startup will demonstrate the following characteristics:

- Experience – people with prior success in other startup ventures is a good indication of value.

- Skills diversity – A mixture of experts whose skills complement the unit adds value to a startup.

- Commitment – An experienced and diverse group is only one part of a successful startup. They should show a degree of commitment and proactive engagement.

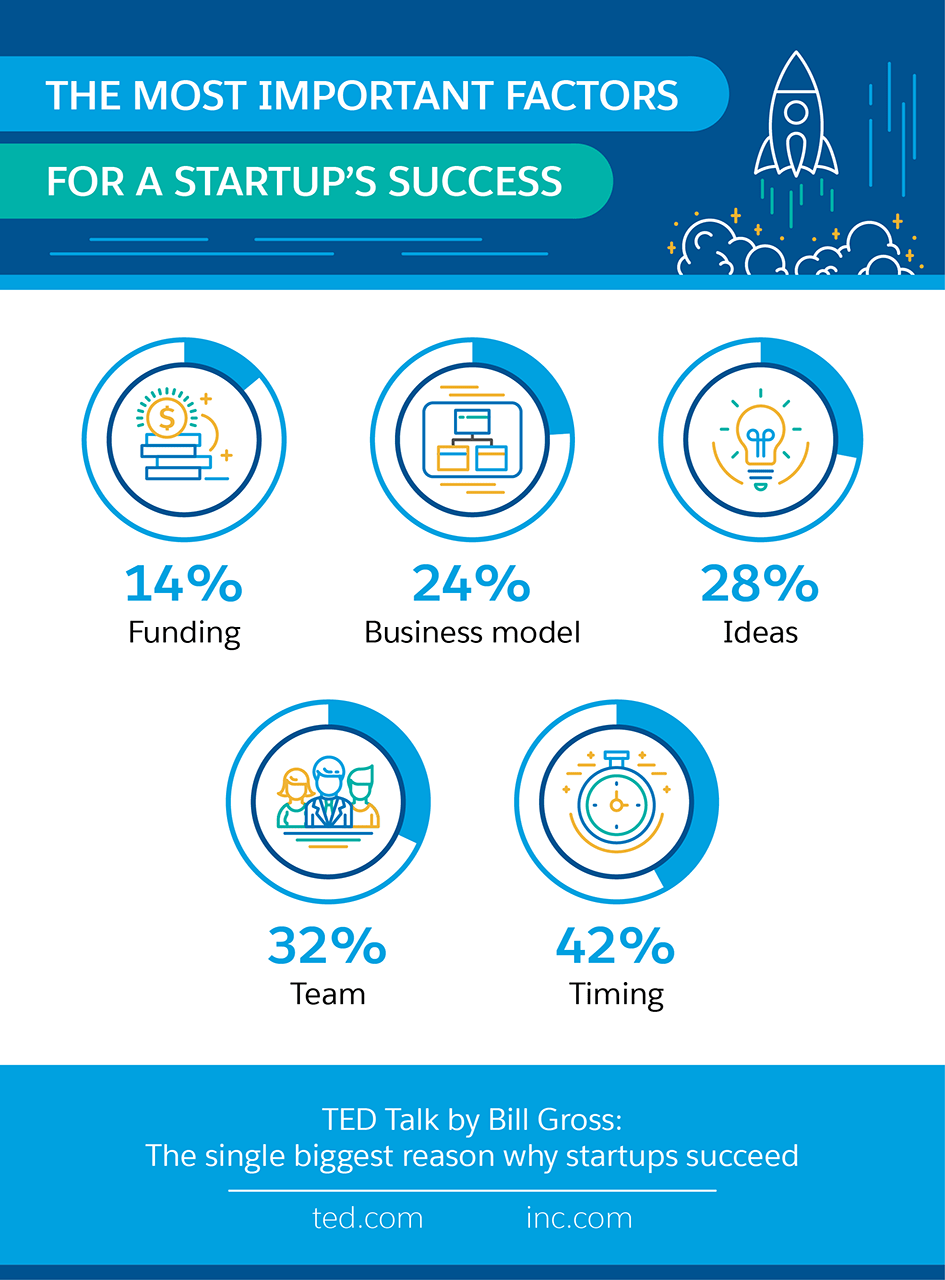

(Startup success. Image: Source)

3. Supply and Demand

Competitive markets will undeniably impact the value of a startup. Operating in a market where the number of business owners is far larger than the number of willing investors will do you no such favours in terms of value. In essence – you could be replaced by the firm next door.

On the other hand, those who have a rare patented idea for a startup that has been making waves in the industry will ultimately drive demand among investors, making said startup more valuable.

4. Latest trends

Some startups are valued high simply by virtue of breaking into a hot industry. For example, booming markets like fintech and artificial intelligence will prompt investors to pay a premium.

Measuring ‘Value’ in a Startup

In a pre-revenue, pre-profitable and pre-cashflow situation, how can we measure ‘value’ and an indication of the worth of a startup? At the startup phase, the most beneficial way to interpret value exists beyond monetary terms.

From an objective and scientific standpoint, startup valuation can be understood in terms of revenue, comparing companies or constructing an EBITDA – all of which we will assess. The ‘art’ of valuation goes beyond these methods to account for subjective strengths such as innovation, team strength and whether there are leads in the pipeline.

The value should initially be thought of beyond monetary terms and then should have a monetary attachment when comparing a startup to similar companies.

1. Cost to Duplicate

The idea behind the cost to duplicate method of valuation is to calculate how much it would cost to build another company just like it from scratch. This approach is used as a guideline for investors to ensure they don’t invest more in it than it would cost to recreate. It looks at physical assets and the conditions of the market to determine a fair market value.

For example, the cost to duplicate a software business might be assumed as the total costs of programming that goes into designing its software. This is a relatively simple thing to determine and can be a powerful tool in valuing a startup. For a high-tech startup, the cost too duplicate might include that of research and development, patent protection, prototype development and distribution.

For companies who have already developed some traction, the cost to duplicate would include marketing efforts and other intangible assets. Overall, it’s seen as a starting point int the valuation of startups – because it’s quite objective. It’s generally reliable since it’s based on verifiable and historic expense records.

The general consensus is that cost to duplicate doesn’t accurately (or at all) reflect the company’s future potential for generating sales and return on investment. It merely accounts for the costs of tangible assets and fails to capture intangible assets like brand value – of which many startups possess at the early stages of their development.

However, the cost to duplicate, on the whale, underestimates a ventures worth. Meaning, it’s used as a “lowball” estimate of company value. It can therefore be negotiated when backed up by the company’s intellectual capital and intangible assets are brought to the table.

2. Market Multiple

This approach is a good way to see what the market is willing to pay for a company, which is a better indication of the true value of a startup. Venture Capitalists like the market multiple approach, since it values the company against recent acquisitions of similar businesses in the same market.

It’s a simple method of valuation. For example, consider mobile application software firms are selling for five-times sales. Understanding what real-time investors are willing to pay for mobile software, a startup can use a five-times multiple as the basis for valuing its mobile applications venture while adjusting the multiple up or down to factor for differences in characteristics.

For example, since a startup will be at a significantly earlier stage of development than other comparable businesses, it would likely fetch a lower multiple than the market’s five – given the fact investors are taking on more risk.

The best thing about the market multiple approaches is that it requires extensive forecasts to assess what the earnings and sales of the business will be once it’s mature. Capital providers will give funds to the business when they believe in the business model’s ability to perform well in the future. As established companies are typically valued based on earnings, the value of a startup is often determined based on revenue multiples.

It’s generally accepted that the market multiple approach delivers value estimates that come tremendously close to what investors are actually willing to pay. However, difficulties arise since comparable market transactions are hard to find. It’s always difficult to find companies that are close enough comparisons in the startup market. In fact, the ones that probably represent the closest comparisons are early-stage, unlisted companies whose deal terms are kept out of the public eye.

3. Valuation by Stage

The development-stage valuation approach is mostly used by angel investors and VC firms to roughly come up with a valuation of a potential investment. It’s essentially a “rule of thumb” approach that depends on the stage of commercial development. The idea behind it, is the further a company has progressed, the lower the company’s risk and the higher its value.

Specific range values always vary, depending on the company and the investor. But it should be remembered that most startups have nothing more than a businesses plan, and will consequently receive the lowest valuations from investors until prove otherwise. As the business succeeds in meeting milestones, investors and the market will be inclined to assign a higher value.

Private equity investors often use this rule-of-thumb valuation by stage method as they provide additional funding to firms reaching milestones int their progress. For example, initial rounds of funding are sometimes targeted towards providing wages for employees to develop a product, which once proved successful, a subsequent round of funding is provided for the next stage of development.

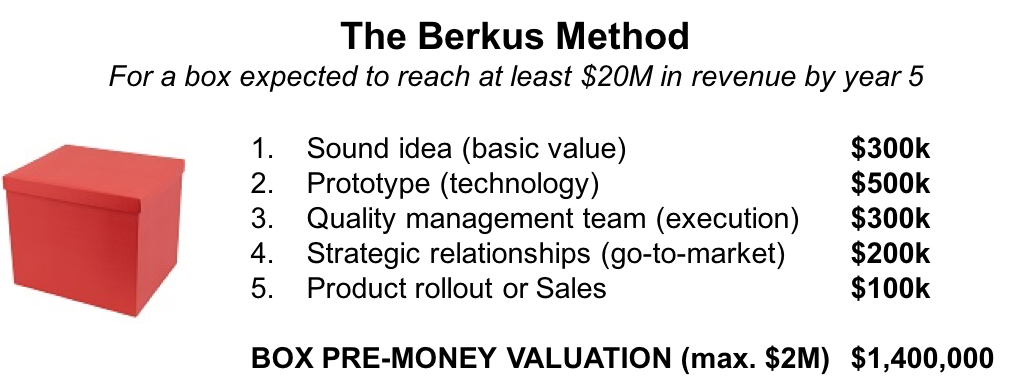

Valuation by stage model is comparable to the angel investor – Dave Berkus’ model of valuation whereby investors should envisage a company breaking $20 million within 5 years. This method depends upon 5 aspects of a startup:

- Concept – basic value with acceptable risk

- Prototype – reduces technology risk

- Quality management – startup should have plans to implement a quality management team

- Connections – strategic relationships in place which should reduce competitive risk

- Launch plan – evidence of a sales plan and preparation for product rollout

Berkus assumes each aspect is given a valuation rating of up to $500,000, meaning the highest possible valuation is $2.5 million. It’s a simple estimation and a useful way to gauge value. Without taking the market into account, it may lack credibility and actionable insight, however.

4. Discounted Cash Flow

Understandably, for most startups who are yet to start generating earnings, the bulk of their value rests entirely on future potential. Discounted cash flow (DCF) analysis is therefore a fundamental unit of valuation when it comes to measuring the value of a startup.

The method attempts to figure out the value of an investment today, based on projections of how it will perform in the future. DCF essentially forecasts how much cash the company will have in the future. It then uses an expected rate of investment return to calculate how much that cash flow is worth.

Since the risk of the startup being unable to generate sustainable cash flows is always imminent – a higher discount rate is typically applied to startups. One of the biggest downfalls of the DCF analysis method is that the quality of the DCF depends on the analyst’s ability to forecast future market conditions and make reliable assumptions about long-term growth rates.

It’s fair to say that projecting sales and earnings beyond a few years effectively becomes a guessing game. In addition to its precarious nature, the value that the DCF model generates is ultra-sensitive to the expected return used for discounting cash flows. Using this valuation method for startups should be done so with much caution.

5. Asset-Based Valuation

Arguably the easiest way to allocate a monetary value to a startup company with no revenue, an asset-based valuation offers a solid assessment of the real value of the startup. This method calls for the evaluation of some key financial metrics:

- The initial costs of the startup’s assets are offset by impairment costs and depreciation.

- The total value of physical assets is added to balance sheet values – including cash on hand and accounts receivables.

- Any outstanding expenses and debts are subtracted from the total to offer an asset-based valuation.

It gives a relatively reliable and objective value of a startup since it accounts for all assets and liabilities. The problem arises when a value is generated based on a startup in its current state, with no recognition of how it will perform in the future.

Whilst investors and the market are most interested in the future value of a startup, this method offers a solid starting point to guide both investors and the startup itself on the merits and financial potential of the startup in its current state – arguably a value of equal importance.

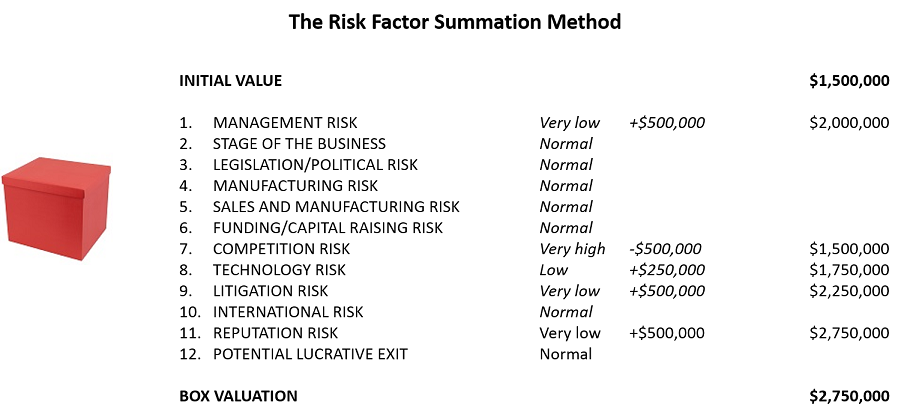

6. Risk Factor Summation

The Risk Factor Summation method (RFS) is essentially an evolution of the Berkus Method of valuation. As Burkus puts it, an initial valuation of the company according to its five aspects is generated. Then the value is adjusted in accordance with 12 risk factors:

- Management risk

- Stage of the business

- Legislation and political risk

- Manufacturing risk

- Sales and manufacturing risk

- Funding and capital risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

The initial value is generated as an average value for a similar startup in a given market and risk factors are modelled as multiples of $250,000. They range from $500,000 for very low risk to -$500,000 for very high risk. As with most pre-revenue startup valuations, the difficult part is finding data on a similar startup.

What not to do when valuing a startup

You could value a hundred startups a day and no one would ever expect you to get it to bang on the money. Mistakes will always be made when it comes to valuing a company with no revenue. As we know, there’s a lot to consider, meaning, there’s a lot to go wrong. There are a two important thing you can do to avoid misjudged startup valuations

1. Don’t assume the valuation will be straightforward

In fact, prepare for the most complicated scenario. There are intangible assets to consider, market conditions to assess and a host of key stakeholders who will want to be on the same page about your valuation. Keep everyone in the loop, a third eye on the external market conditions and be innovative with the ways you can identify and measure intangible assets like brand awareness, demand and loyalty. It’s these factors that will ultimately carry the weight of a startups’ value.

2. Don’t assume your valuation is permanent

The very goal of all startups is to eventually and as quickly as possible, progress. It’s the rewards that come with the risks. Goalposts will be moved, earnings will fluctuate and the brand will grow (hopefully). Startups will be worth whatever investors are willing to invest in it. Startup entrepreneurs may disagree with the value placed on their venture. It’s important to remember that no valuation, high or low is ever permanent – nor is it necessarily correct.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)