The buying and selling of stocks, shares and equities work in a similar way to any market place. Effectively, parties negotiate a price at which to exchange an asset. Institutions, such as stock exchanges facilitate the exchange of publicly listed shares. Once the company’s shares start trading, its share price is determined by supply and demand for its shares in the market.

Investors are typically more inclined to chase and invest in growth stocks – but what happens when a stock is significantly undervalued by the market? Should such stocks be neglected in favour of the high-performing and potentially dividend-paying stocks? After all, why would an investor seek to buy undervalued stock with no immediate or short-term capacity to generate capital gains?

(Market price vs. intrinsic value: when stock becomes undervalued. Image: Wealthy Retirement)

What are undervalued stocks?

An undervalued stock is one with a market price that is significantly lower than its real or ‘fair’ value (market value < fair value). Stocks can be undervalued for many reasons, including a decrease in investor confidence, the financial health of a company, negative press and market crashes. Conversely, stocks can be deemed undervalued if the company’s fundamentals improve rapidly while the market price remains constant.

Financial analysts use the price-to-earnings ratio (P/E) to determine if a stock is undervalued. One of the key assumptions of fundamental analysis is that market prices will correct themselves over time to reflect an asset’s ‘fair’ value, which creates opportunities for profit.

It should be noted that finding undervalued stocks is not just about finding ‘cheap stocks’ that remain useless. The idea is to find great quality stocks with the potential to perform well, but just happen to be priced under their fair value. The difference here is that good quality stocks will rise in value over time as the market adjusts.

Identifying and investing in undervalued stocks has become a popular investment strategy. If traders can identify a stock trading at a different price from its ‘fair’ value, they’re likely to find an opportunity to profit.

Why do stocks become undervalued?

Upon looking for undervalued stocks, as well as once you’ve found them, it’s important to determine the reason for the undervaluation. This can help you to forecast expected rises in value and assess the stock’s ‘fair’ value. There are quite a few reasons which lend to the undervaluation of stocks.

The market is down

This is often the most glaringly obvious cause of a stock’s undervaluation and it typically occurs when the macro view of the economy is poor. In such instances, investor confidence is low, aggregate demand falls and businesses slack. It’s always useful for investors to have the tools to value the market in order to prepare as the market becomes undervalued.

The macro view of an industry

Investor perception of the health of the industry is key to the value of the stocks which float within it. When the macro view of a particular industry is poor, industry stocks can take a hit. For example, in the 90s, the prospects of Hillarycare in the US took down healthcare-related stocks.

Severe short-term problems

Harsh short-term problems which do not damage the business franchise will almost always see some undervaluation effects on its stock. The trick here is to understand which problems are likely to be ‘short-term’ and deliver a bounce back in value. Companies with competitive advantages or low-cost structures are more likely to experience short-term undervaluation.

A company has not paid or has cut its dividends

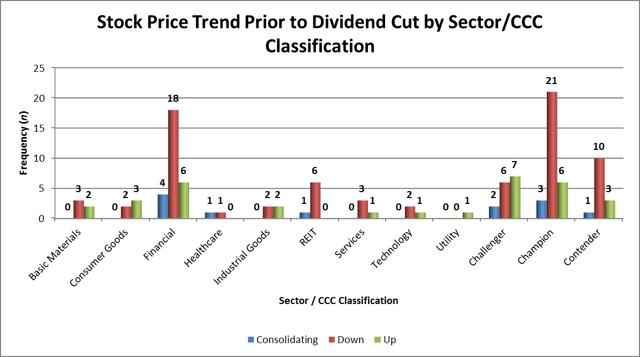

(Movement of stock prices following a dividend cut. Image: Simply Safe Dividends)

The chart above illustrates the effect on stock price following a dividend cut per sector. The red bars represent a fall in the price of the stock. What’s clear amongst most sectors, is that the immediate implication of a cut in dividends is a decrease in the value of the stock. This is particularly true in the financial and champion industries.

Understandably, when a strong company has had to cut its dividends for whatever reason – this could be to fund alternative growth projects – shareholders become inclined to offload their stock. A flood of shares on the market could see an undervaluation that typically does not reflect the stocks ‘fair value’. Such stocks are likely to see an imminent rise in value, following company expansion, or financial stability.

A company is not followed

If a small company has little or no analysts following it to cheer it on and report on its ‘fair’ value, its stocks may be undervalued by neglect. Investors should take it upon themselves to follow smaller companies for competitive advantage and opportunities for profit.

Spin-off companies

This has become known to many experienced investors as a classic opportunity area. The new spin-off company may find excellent economics and prospects which were simply not understood or appreciated when it was part of its parent company. By breaking off, a spin-off company will face the stock market alone – weaker and unappealing. It’s likely to experience an appreciation in value once its economic prospects are seen.

Companies emerging from bankruptcy

Bankruptcy tends to be a scorcher with long tasting reputational damage and the market often fails to recognise the value of a newly organised company that is free of its heavy debt burden. Given time, such companies often bounce back stronger.

A complex company

When a company is too complex, and when most investors don’t really understand a given situation or are unwilling to put in the work to keep up, it may make an undervalued situation available to astute value investors.

Cyclical fluctuations

Stock in some industries fluctuates between performing well and performing poorly over certain quarters, which affects share prices in the short to medium term. Similarly, when stocks don’t quite perform as predicted, the price can take a hit.

How traders find undervalued stocks

There are a variety of ways for traders to find undervalued stocks. Amongst the most common, fall into a form of either fundamental analysis or technical analysis and are more often than not, a combination of both.

(Fundamental and technical analysis. Image: Medium)

Fundamental analysis is a method of evaluating the value of an asset by examining external events and influences, as well as industry trends and financial statements. There are two types of fundamental analysis: top-down analysis and bottom-up analysis.

In a top-down fundamental analysis, an investor will begin by analyzing the broader economic picture before identifying companies with the potential to perform well in such circumstances. The bottom-up fundamental analysis involves analysing a particular company’s fundamentals before looking at the broader economic landscape.

Technical analysis is a means of examining the and forecasting price movements using statistics and historical data. Traders will typically look for repeated chart patterns and use technical indicators to find profitable stocks to trade on.

Generally, traders should use both methods together for a comprehensive overview of the market and the company, in order to find undervalued stocks. However, there are a few specific financial ratios and metrics that form part of fundamental analysis that traders should always consider when looking for undervalued stocks.

Ways to find undervalued stocks

As part of a comprehensive fundamental analysis, a series of ratios are commonly used by traders and investors. The following ratios can be used to identify undervalued stocks and more importantly, determine their true value. Do keep in mind that a ‘good’ ratio will of course vary by industry since they have different competitive pressures.

Price-to-earnings ratio

A company’s price-to-earnings ratio (P/E) is the most common way to measure its value. In effect, it simply shows how much you’d have to spend to make $1 in profit. A P/E ratio is calculated by dividing the price per share by the earnings per share. Earnings per share are calculated by dividing the total company profit by the number of shares they’ve issued. A low P/E could suggest that the stocks are undervalued.

For example, you buy PFE shares at $50 per share, and PFE has 10 million shares in circulation and generates a profit of $100 million. Earnings per share are $10 ($100 million/10 million) and the P/E ratio is 5 ($50/$10). Meaning, you’d have to invest $5 for each $1 in profit. The lower the P/E the more likely the stock is undervalued.

Debt-equity ratio

The debt-equity ratio (D/E) measures a company’s debt against its assets. It’s a useful metric in its ability to determine the value of a company’s stock. A higher D/E ratio could indicate that the company gets most of its funding through lending, not from shareholders – but this doesn’t necessarily mean that its stock is undervalued.

To gain insight into the value of a stock, a company’s D/E ratio should be measured against the average of its competitors, since the effect of a ratio depends on the industry. The D/E ratio is calculated by dividing liabilities by shareholder equity.

For example, company PFE has $1 billion in debt and a shareholder equity ratio of $500 million. The D/E ratio ($1 billion/$500 million) would be 2. Meaning, there is $2 of debt for every $1 of equity.

Return on equity

Return on equity (ROE) generates a percentage as a measure of a company’s profitability against its equity. It is calculated by dividing net income by shareholder equity. Indication of undervalued stocks is a high ROE since the company is generating a lot of income relative to the amount of shareholder capital investment.

If PFE has a net income of $90 million and stockholder equity of $500 million; the ROE is 18% ($90 million/$500 million).

Earnings yield

In other words, the earnings yield is effectively the P/E ratio in reverse. Rather than dividing price per share by earnings, the earnings yield looks at earnings per share divided by the price. Traders will typically consider a stock to be undervalued if the earnings yield is higher than the average interest rate set by the government.

If PFE has earnings per share of $10 and the share price is $50, the earnings yield will be equal to 20% ($10/$50).

Dividend yield

This calculates a company’s annual dividends, which is the portion of the company’s profits paid out to shareholders compared to its share price. To calculate this percentage, one divides the annual dividend by the current share price. Investors are attracted to companies with solid dividend yields since it offers more stability and substantial profits. A disproportionately high dividend yield is a strong indication of an undervalued stock.

Should PFE pay dividends of $5 per share each year, at the current share price of $50, the dividend yield is 10% ($5/$50). Generally, a 10% dividend yield is a strong investment and indicated a fairly valued stock.

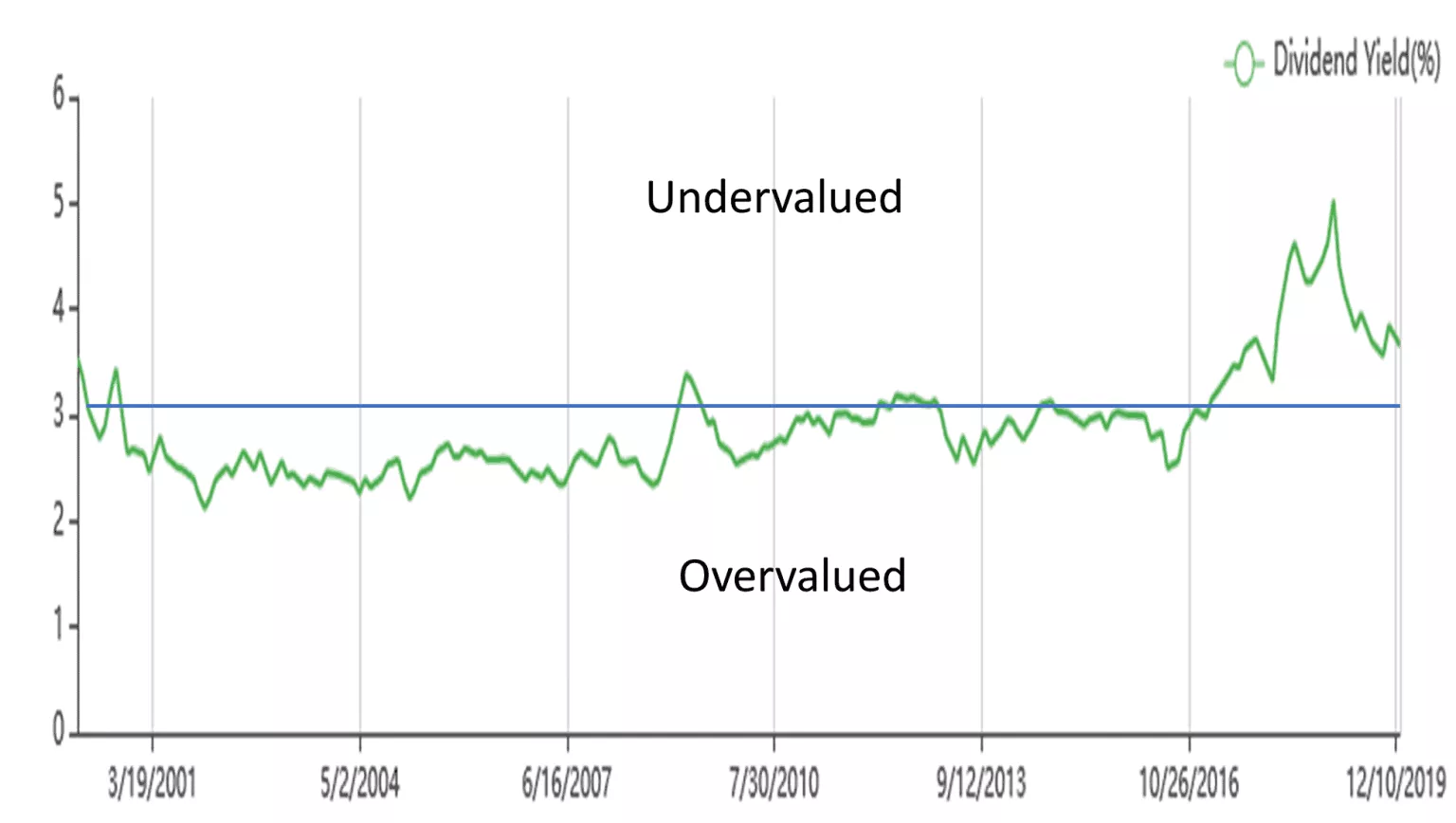

(Dividend yield theory. Image: Academy of Finance)

According to dividend yield theory, a stock is overvalued when the yield is low and the price is high and is undervalued when the yield is high and the price is low. The precise yield at which a stock becomes undervalued is dependent on its historical data over the years.

Current ratio

This is a measure of a company’s ability to pay off its debt. The current ratio is calculated by dividing assets by liabilities. The general rule of thumb here is that when a current ratio is lower than one; it means liabilities cannot be adequately covered by the available assets. So, the lower the current ratio, the higher the likelihood that a stock price will continue to fall – potentially to the point of it becoming undervalued.

For example, if PFE has $1.2 billion in assets and $1 billion in debt, the current ratio would be 1.2 ($1.2 billion/$1 billion).

Price-earnings to growth ratio

Price-earnings to growth ratio (PEG) examine the P/E ratio relative to the percentage growth in annual earnings per share. Put simply, if a company has solid earnings and a low PEG ratio, it could mean that its stock is undervalued. PEG ratio is calculated by dividing the P/E ratio by the percentage growth in annual earnings per share.

PFE has a P/E ratio of 5 (price per share divided by earnings per share) and its annual earnings growth rate is 20%. Its PEG ratio would equal to 0.25 (5/20%).

Price to book ratio

The price to book ratio (P/B) is used to evaluate the current market price against the company’s book value – its assets minus liabilities, divided by the number of shares issued. To calculate the P/B, divide the market price per share by the book value per share. A stock is considered to be undervalued if the P/B ratio is lower than one.

PFE’s shares are $50 a share and its book value is $70, meaning the P/B value is 0.67 ($50/$70). In this case, the P/B is an indication of undervaluation.

These ratios form part of the fundamental analysis which traders and investors alike use to find undervalued stocks. However, there are some qualitative measures to take into account when determining whether the stock of a company is undervalued or not. These include the earning history of a company, making sure it hasn’t indulged in any financial scam, and that their products have the potential to sustain and be profitable in the future.

Who should invest in undervalued stocks

Undervalued stocks, more than most others, have considerable potential to yield substantial returns if investors can sufficiently recognise and analyse the different variables related to such stocks.

Analysing companies and their value to determine their earning potential require significant technical knowledge. Value investors duly wait for market conditions which render the market price of stock well below its fair intrinsic value. These investors follow the principle that if they can purchase discounted stocks, then why should they buy them at their face value or higher.

Investors with substantial knowledge, experience and expertise in the stock markets dynamics should indulge in undervalued stock trading. Without the required skills and understanding of the stock market, the wider economy and sector-affairs; inexperienced investors risk mistaking an undervalued stock for poor quality, a low-performing dud.

Warren Buffett’s admission demonstrated that investing in undervalued stock can bring seismic returns when approached with caution. It’s relatively easy to determine whether investing in undervalued stocks is right for you; simply look at the differences between undervalued stock investing and the general approaches to stock trading.

Can your own personal goals and requirements afford to lock money away in shares for the next decade, if need be? Can you remain patient and calm in the face of fluctuating markets? What’s your appetite for spotting market trends like?

Risks and rewards of trading undervalued stocks

Investing in undervalued stocks could provide a stable investment approach in an evolving market. Undervalued stocks are a particularly smart asset for any diversified portfolio – when done well. A healthy mix of undervalued and growth stocks can be advantageous to investors in providing access to big wins; whilst keeping them protected from the draining effects of bear markets.

Studies have shown time and time again that the single greatest inverter strategy is diversification. By compounding your interest, undervalued stocks should consistently deliver over time as the market readjusts to their intrinsic value.

Due to the nature of the free market, undervalued stocks will automatically return to their intrinsic value; where profits are assured. The most difficult part of trading undervalued stocks is in finding them. From then on, the market takes care of the rest.

Not to mention, undervalued stocks feature a significantly low risk since such undervaluation is cyclical in nature. When a sound company has the ability to retain its intrinsic value, so too will its stocks. Even if it means it may take some time for the market to give such undervalued stock credit where it’s due.

As with all investments, undervalued stocks come with their own set of risks and pitfalls. The most common is that investors – including the most experienced – run the risk of flawed analysis. There is, after all, no guarantee that an undervalued stock is indeed undervalued. Whilst through considerate fundamental analysis, most investors can get close to certain, there is always the risk of mistaking an undervalued stock for a defective stock.

Another pitfall to the undervalued stock market is that they’re not exactly common. Not all investors will have access to invest in such funds. For those who dedicate themselves to finding them and reaching the hail of potential huge returns; it can be time-consuming. Each ratio used in fundamental and technical analysis takes time.

In summary, investors looking for short term gains may not be as thrilled to land themselves access to undervalued stock, since they need longer than the ‘short-term’ to show their true worth. However, for patient investors who have exhausted all analysis tools, calculations and metrics, and believe in the fundamental soundness of a company; investing in undervalued stocks should prove rewarding.

![How Options Trading Works: The Ultimate Guide [2021]](https://daglar-cizmeci.com/wp-content/uploads/2020/12/Options-Trading-400x250.jpg)