Many of us try to manage our finances without any external help. However, for individuals and entrepreneurs alike, cashflow is rarely simple. Preparing for expenditures like moving home, or putting the family through college, or scaling your business can all cause unnecessary headaches, but wealth management could be on-hand to help out.

Firstly, it’s important to note that wealth management is fundamentally different from investment management. While investment management mostly pertains to selecting the right stocks, bonds and funds to invest in, wealth management takes on a more comprehensive approach.

Wealth managers get to grips with your entire retirement planning and build an investment profile based on where you are in life and what your goals are. For instance, younger clients may find wealth managers allocating riskier, high-yield asset classes such as stocks, whereas older clients may be allocated more stable investments that offer fixed returns.

To help cater to the more personal wants and needs of clients, wealth managers will take on a much more personal approach in order to comprehensively tailor-fit portfolios to their clients.

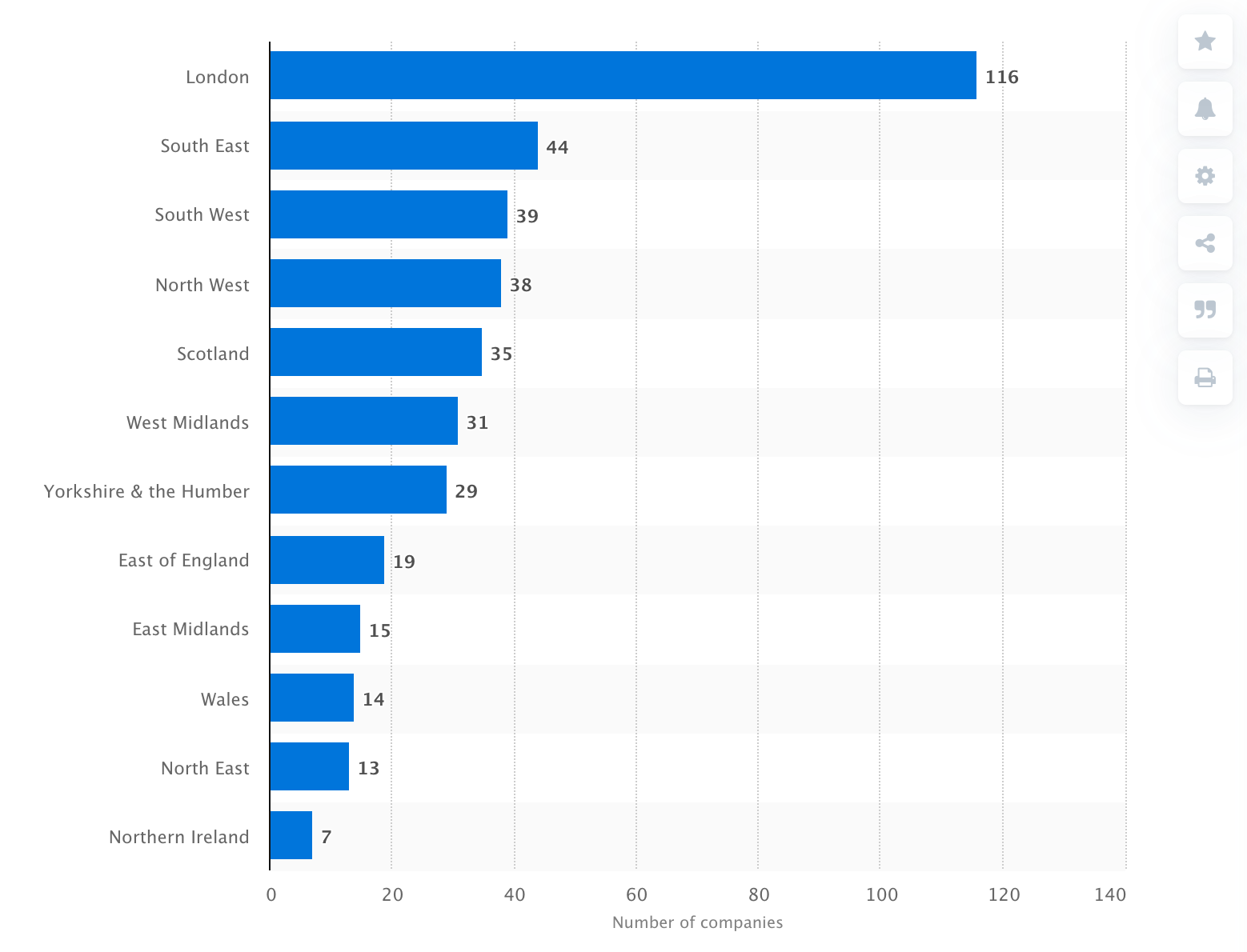

(Number of wealth management firms in the United Kingdom. Image: Statista)

Wealth managers don’t simply set your funds up and then manage them remotely. They collaborate with your accountants and lawyers to plan your outgoings, such as taxation and insurance requirements. In US markets, wealth managers can help industry professionals like doctors take out protective insurance policies to help shield them from patients wishing to sue.

While some professionals may label themselves wealth managers, their job roles extend little beyond the realms of investment management. Because of this blurring of the lines between the roles, it’s important to discuss the level of service that wealth managers offer you.

If you’re looking to optimise your incomings and outgoings alike, it’s worth enlisting the help of a wealth advisor. Below are five key reasons why you may be missing out if you’re still trying to keep on top of your wealth all alone:

1. Keep Prepared

Sadly, for many of us, we only choose to reach out for professional financial guidance after a significant life event like a family illness, divorce or inheritance. This tends to make our approaches to wealth management flat-footed and reactionary, as opposed to pro-active and anticipatory.

Taking on the help on an advisor before a crisis could hit ensures that they’ll already be aware of your full financial picture, and will be able to show agility and value when the unexpected occurs.

Having shared your goals and agreed on an informed strategy with your wealth advisor, adverse events will be far less likely to throw you off track with your portfolio.

Preparing to manage your wealth provides you with a clear head start on optimising your finances and understanding how to achieve your goals. Taking a pro-active approach in this circumstance will lead you to having more choices if and when setbacks occur.

2. Building Wealth

You may have built your wealth as a wise entrepreneur, or you might have worked your way to the top of a company on merit, or you may have received a significant inheritance from a loved one. Either way, your ultimate ambitions will likely be similar: maintain your wealth and grow it for generations to come.

Property and land are generally assets that appreciate over time, but what about less commonplace assets like old cars, antiques and furniture? How do these items work as investments? Should they be sold in auction or held over time? Wealth managers are on-hand to help you to find the true value of your wealth and invest it in a variety of value-adding ways.

As Echelon notes, art is establishing itself as a primary long-term approach to investment in Sri Lanka, and finding the right wealth manager to support you on this could help you to take on a brand new alternative approach to filling your portfolio with appreciating assets.

The beauty of wealth managers is that they’re trained to find value beyond the traditional markets that the majority of investors will be looking at. As somebody who will no doubt have their own jobs and companies to manage, gaining the help of a dedicated finance expert could pay dividends when value investment opportunities are discovered.

3. Tax Management

Is your tax bill starting to take its toll? One of the most effective ways of managing your wealth doesn’t involve finding value investments but is focused on keeping unnecessary expenditure down.

Tax planning is a pivotal part of wealth preservation. Whether you’re paying Income Tax, Capital Gains Tax or Inheritance Tax, finding a knowledgeable wealth manager can help you to bring down your tax spending and maximise the potential of your portfolio.

The tax advantages of ISAs and pensions speak for themselves, but wealth managers can often provide clients with actionable recommendations on how to minimise their respective tax obligations. Advisors can even find certain assets that have received appealing tax incentives from the government – such as Enterprise Investment Schemes and Venture Capital Trusts – both of which can work wonders in lowering your tax bills.

4. Time-Saving Management

For most people who call on the help of a wealth manager, there simply aren’t enough hours in the day to continue to commit to their work, families and friends all while maintaining an eagle-eye focus on your finance.

You may have reached a stage in your life where your career demands all of your attention, or you’re having to spend more time caring for children or older members of your family.

When this occurs, time can feel precious. Sadly, the management of your investments can be an extremely time-consuming activity for those who are aiming to maximise their earnings. The act of following markets, studying financial reports and analysing economic data can be simply too demanding to keep on top of.

Wealth managers are often employed by clients to take care of the time-consuming work on their behalf. This leaves clients to spend their newfound free time however they see fit.

5. Gain Financial Fluency

For other clients, enlisting the help of a wealth manager isn’t about saving time, but more down to the fact that they don’t have enough confidence in the markets to invest their money wisely.

Wealth advisors can provide deep insights into how individuals can better invest their finance while maximising their earning potential. Some firms even offer to educate their clients on their marketing knowledge as they go, in order to help them understand exactly how their wealth can grow.

It’s important to be aware of where your money’s going and how it’s going to be turned into sustained growth. Understanding the risks associated with the investment strategies your advisor’s undertaking can help you to learn more about how you can achieve your goals, and to plan ahead for future management strategies.

Finance has a habit of refusing to sit still, and the value investments of yesterday could always carry the risk of turning toxic tomorrow.

Wealth managers are on hand to assist you with your wealth in a much more personalised way. Learning about your goals and ambitions and detailing every step of the process they recommend in helping you to achieve the financial security you need.