Blockchain technology continues to revolutionise the future. As we step into the digital age, it’s no surprise that new technological advances are beginning to remould a number of different sectors. From the financial industry to the corporate landscape, the digital shift has begun to automate and accelerate daily tasks across a wide number of industries.

Blockchain ledgers are just one type of technology transforming the future. From banking to business and healthcare to education, blockchain’s decentralised properties are quickly becoming popular amongst business leaders and financial giants as they promise to improve transparency, streamline accounting and provide ultimate data security.

For the corporate sector, in particular, the onset of the Covid-19 pandemic pushed a large number of business practices online. That means that more data than ever before is being shared across a digital portal, increasing the risk of cyberattacks and hacking threats.

With 86% of business leaders claiming that blockchain will reach the mainstream by the end of 2022, we are beginning to see worldwide adoption of blockchain across the corporate sector in the wake of Covid-19.

The question is, just how secure is the future? Can blockchain security revolutionise the future of corporate data sharing, or are business leaders still at risk in a new online landscape? Read on as we delve into the potential of blockchain in a post-pandemic corporate world and find out whether this decentralised technology is the key to success.

What Is Blockchain?

Before we get into the benefits and potential challenges of this new technological development, it’s important to understand exactly what blockchain is and how it can be utilised in a modern digital environment.

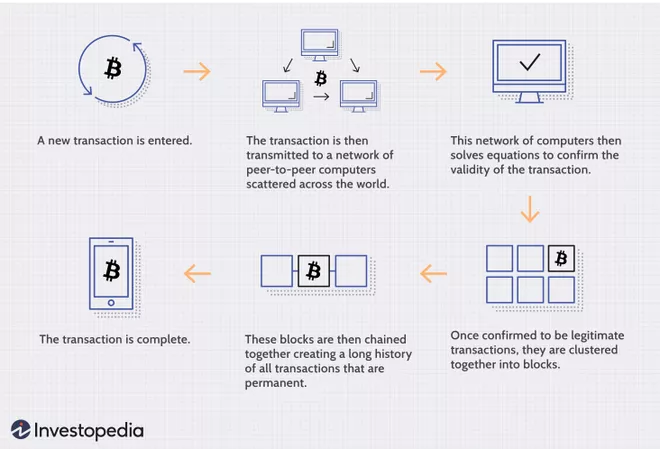

Investopedia defines blockchain as “a distributed database that is shared among the nodes of a computer network.” Used to store large amounts of information in an electronic format, blockchain can facilitate a number of secure and decentralised transactions

Removing a centralised third party, blockchain’s automated system can quickly encrypt large amounts of data that can be stored and distributed, but not edited within the transaction process. Also known as Distributed Ledger Technology (DLT), a blockchain network can create an irreversible timeline of encrypted data that can be collected together in groups known as blocks before connecting to create a time-stamped chain.

Since the concept was discovered in 1991, blockchain has since facilitated a number of now mainstream applications ranging from cryptocurrency and NFTs to smart contracts and decentralised finance.

(Image Source: Investopedia)

A Transparent Process

The beauty of blockchain is its transparency. Priding itself on being a decentralised process, blockchain transactions can all be transparently viewed at all stages of the chain. Whether it is a financial transaction or an information exchange, each blockchain node creates a new copy of the current chain that makes it easy for users to track and document a data transaction.

Better still, blockchain’s decentralised nature allows the data transaction to be stored across a network of computers. Rather than storing information in one centralised location, each computer network involved within the translation is constantly updated as new blocks are added, making it harder to be hacked by cybercriminals. For example, if a hacker was to breach the ledger’s cyber security, they would only ever find a single copy of the information as a pose to the entire network.

The question is, just how effective is blockchain security and can it be trusted by new entrepreneurs on the scene?

The Future Of Blockchain Security

Did you know that there is a Ransomware attack across the globe every 14 seconds? A 2019 Annual Cybercrime Report (ACR) revealed that not only do most cyber attacks go unreported, but they continue to rise as more of us move online.

As technology’s potential continues to advance in a fast-paced landscape, so does the potential for cyber attacks. With new 5G networks offering download speeds that are 10 times faster than older models, the ability to share data at an accelerated pace has only increased the chances of large cyber security breaches.

This is where blockchain steps in. While it is not unbreakable, blockchain’s decentralised ledger has become one of the world’s most secure means of transaction. Let’s have a closer look into the future of blockchain security and see how it is strengthening modern-day cybersecurity.

Securing Data Exchanges

Blockchain has the power to encrypt and decrypt data during the transaction process, preventing unauthorised access within the chain.

Securing the data exchange process has become vital for a number of sectors post-pandemic. As more of the corporate industry become remote and cross-border transactions move away from traditional banking institutions, blockchain technology is able to assist data exchanges and prevent malicious intent.

As hackers are no longer able to edit, alter or delete blockchain encrypted data, using a decentralised ledger for securing mass data transactions is vital in the digital age.

Enhancing Private Messaging

As more people join the world of private messaging, whether it’s social or work-related, there are new collaboration and instant message-based platforms cropping up than ever before. From Slack to Whatsapp, large amounts of metadata is being collected every few seconds as the world continues to digitally converse.

Stepping into a post-pandemic digital age, instant messaging platforms are slowly beginning to adopt a blockchain-based encryption strategy. Using a unified API framework, blockchain technology can assist cross messenger communication and prevent hackers from hacking unreliable, weak passcodes.

Securing user data, blockchain technology will prevent future breaches of social platforms such as Twitter and Facebook which have been victims of considerable data breaches in the past, enabling users to feel safe as they converse online.

Protecting Corporate Data

As business leaders continue to optimise their WFH potential, the challenges of moving online have left them vulnerable to data breaches. In fact, most corporate organisations still utilise centralised forms of storage medium, which are extremely vulnerable in a cyber attack.

Data that is stored within these systems is easy to exploit, leaving business records and large amounts of confidential data in the possession of a cybercriminal.

When introducing blockchain technology, this risk is significantly reduced as a decentralised system can ensure that corporate data is stored in a number of networks, rather than one easily hackable storage medium.

Revolutionising The Corporate Sector

On the back of the pandemic, the corporate sector has seen great reform. As we step into a new virtual society, both the corporate and the e-commerce landscape has displayed a real shift towards consumerism.

In fact, the e-commerce sector alone grew by 35% in 2021, as the tech industry revolutionised the future of consumer success. As the ongoing changes continue to play out across a new digitally flexible landscape, the question is, how could the corporate world evolve in the future?

As the corporate sector responds to these new challenges in a digital playing field, the focus is on both stakeholders and new entrepreneurs entering the game. Head of European Equities, Maarten Geerdink states that the future of the corporate landscape is in the hands of stakeholder prosperity as they adapt and invest in a digital future.

“What matters now is how all stakeholders, governments and regulators, individuals, and companies themselves, respond to these cataclysmic changes” he claims.

As the pandemic highlights the importance of flexibility, two key areas set for reform are both business operations and supply chain automation. As AI developments hit the corporate scene and intelligent automation revolutionises company dynamics, is blockchain technology also playing a role in the corporate sector of tomorrow? Let’s find out.

The Effects Of The Pandemic’s Digital Shift

Prior to the 2020 Covid-19 pandemic, only 30% of corporate employees worked from home full time. As lockdowns sent us back inside, this number quickly rose to 70% of the global corporate workforce, who quickly had to adapt to new forms of corporate digitalisation.

From remote communication tools to immersive onboarding aids, both virtual reality and augmented intelligence transformed the WFH culture.

(Image Source: Gartner)

Stepping into a post-pandemic digital workspace, we see a number of productivity-based and data-handling tools improving the future of remote working. In fact, as 38% of WFH based companies plan to implement at least one of these digital aids in the workplace in 2022, it’s no surprise that the corporate sector is seeing a significant digital shift.

For example, new VR technology has enabled company leaders to onboard staff members remotely in an immersive environment, while new data security-based applications, such as blockchain ledgers have improved data sharing on a global level, in a secure decentralised system.

The physical office is quickly becoming obsolete, as new entrepreneurs continue to invest money that once went on physical operations, into a new digitalised alternative.

In fact, a new study from Hello Global found that the introduction of digital aids into the remote workplace has improved corporate productivity by a whopping 33%.

The question is, could digitalisation also improve corporate security? As our networks widen in a new virtual setting, both corporate giants and ambitious start-ups face a new threat. Hacking and cybercrime are at an all-time high throughout the corporate sector. As business leaders continue to store and share data amongst online platforms, the risk of data hacking only increases.

Experts predict that cybercrime alone will cost the world $10.5 trillion annually by 2025, rising 15% per year as more companies and consumers move online. As we step into the future of post-pandemic digitalisation, could the corporate sector be under threat?

Could Blockchain Be The Key To Success?

Operating within a landscape of mass data transactions, blockchain technology could be the key to success for the corporate landscape. With cybersecurity crime at an all-time high on the back of the digital shift, blockchain adoption within the sector has never been higher.

In fact, 84% of corporate leaders claim that their companies are involved with at least some aspects of blockchain technology. This number is expected to soar exponentially within the next 5 years. As blockchain ledgers continue to secure and encrypt both financial and data transactions, corporate giants are taking no risks as we step into a digital future.

Blockchain Leader at PWC, Steve Davis, believes that blockchain adoption across the sector as a whole will increase transparency in a post-pandemic environment.

“Blockchain technology has the potential not only to provide the UK economy with a significant boost but also improve the way organisations operate. It’ll make processes faster and more effective and create greater trust and transparency around any transactions they carry out.” He comments.

Let’s have a closer look into some of the main benefits blockchain technology could bring to the corporate sector, and why it is more important than ever for entrepreneurs to invest.

The Benefits Of Utilising Blockchain In The Corporate Industry

There are a number of benefits associated with utilising blockchain within the corporate industry. From sharing numerous records securely to streamlining the supply chain, a number of corporate companies could benefit from introducing blockchain technology into their success strategy.

In response, corporate security has improved and greater levels of transparency have invoked new trust in cross-border transactions in a digitally remote setting. Here are just some of the ways, it can revolutionise the industry and what is yet to come.

Improved Corporate Security

Did you know that small businesses make up 43% of cybercrime targets? According to a recent report by Cybint, nearly two-thirds of small corporate companies have been exploited by cyber hackers in a number of phishing and DDoS attacks in the last three years.

Traditional data sharing methods have left corporate companies vulnerable in the wake of new digital advancements. Using a predominantly centralised system to store company data and record cross-border transactions can make it easy for online hackers to hack into company systems and breach data privacy.

In fact, the cost alone of cyber threats can be enough to completely close down small business ventures. A recent Security Intelligence Report found that data breaches could cost company leaders up to $4 million, especially as new cyber-attack tools become more readily available across the dark web.

As blockchain technology aims to create numerous records of data transactions across a plethora of different networks, data transactions are harder to exploit, as a hacker will only ever gain one copy of the data, rather than the entire network itself.

Secure Data Sharing

Blockchain technology also ensures that both company records and important data are shared securely across relevant parties.

Traditional transaction methods can leave company data vulnerable to theft, however, blockchain’s encryption technology can ensure that data is only accessed using a key code. Better still, the transparent sharing process can be viewed at all stages by all parties involved, and automatically copies itself into a new ‘block’ when edited or interacted with.

Automating the transaction process also ensures efficiency. Did you know that 95% of cybercrime breaches are down to human error? Removing the need for a centralised verification system is a great way to reduce company costs and ensure security between transactions.

Efficient Supply Chain Management

For e-commerce based companies, in particular, one of the greatest challenges for business leaders post-pandemic is supply chain management.

In a fast-paced manufacturing environment, there is often a global supply chain, where a number of components of one product are produced all over the world. For large e-commerce giants, in particular, it can be hard to track and maintain records of product development across the globe.

In response, blockchain is revolutionising large corporate giants such as Walmart and Nestlé, who are using blockchain technology to enhance their verification process. Using a decentralised ledger that tracks all stages of the supply chain, blockchain adoption is quickly eliminating supply chain disputes as both the company leader and the supplier can view the ledger at all stages of the chain.

Chainyard, one of the blockchain providers pioneering the way forward, claim that its impact on supply chain management will be vital for post-pandemic corporate success.

“Creating new supplier categories and finding qualified vendors within each category is an onerous process,” they comment. “With blockchain, however, you can easily access supplier records, information from government agencies and insurers, and prior verifications completed by trusted parties, all in one place.”

Automated Accounting

Blockchain is also automating the accounting process, bringing greater efficiency to the transaction procedure.

Blockchain automation can reduce the need for human intervention, allowing financial auditors to have more time to focus on important tasks such as spotting errors and abnormalities within the transaction process.

The Journal Of Accountancy’s Editorial Director, Ken Tysiac states that “Blockchain’s transparency gives visibility to all transactions for approved users, and this may decrease auditors’ work with sampling and validating transactions.” Automating the process allows company leaders to utilise their workforce more effectively while digitalising a process that can be susceptible to human error.

Are There Any Concerns?

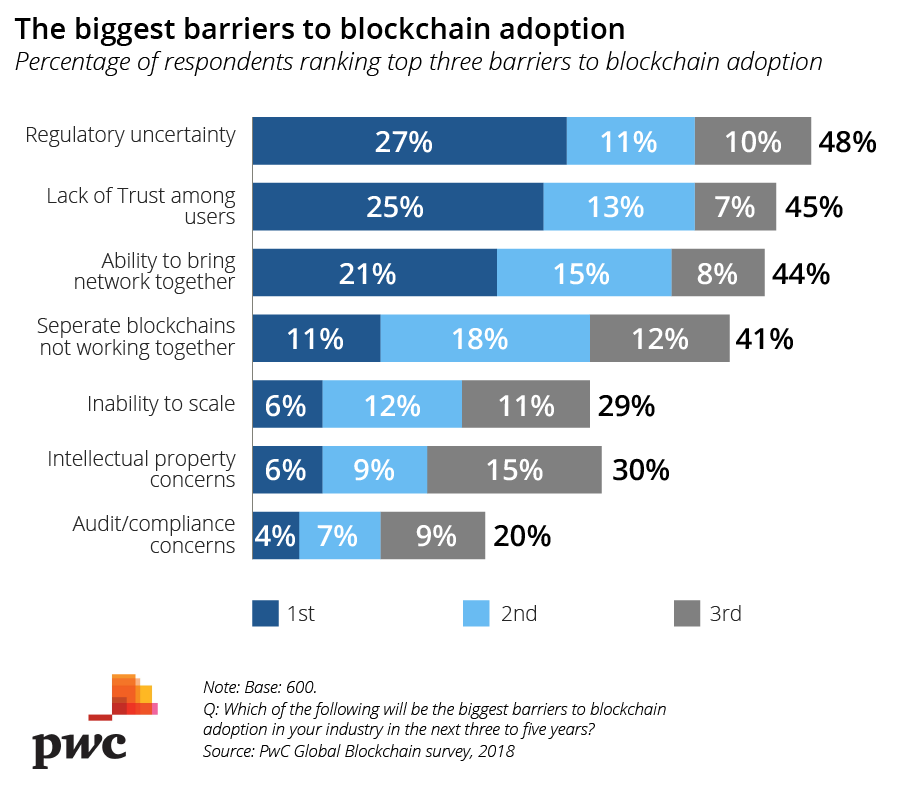

With any technical evolution comes concern. In the wake of blockchain going mainstream, there are still some barriers surrounding the adoption of the technology within the corporate sector.

From regulatory uncertainty to the inability to scale, there are a few challenges concerning full-scale adoption within the sector.

(Image Source: PWC)

As you can see above, 27% of the respondents in a recent PWC survey suggested that the largest blockchain barrier is regulatory uncertainty. As company leaders question policy and regulatory changes that might affect the trading market and its many consumers, the uncertainty of blockchain success, can be an issue to navigate, especially for small business owners.

In order to ensure that concerns are addressed, it’s important to create a blockchain-based business model, prior to adopting the technology. Research into competitor companies alongside implementing controls into the business to mitigate risks is essential for corporate leaders who are new to the game.

Meet The Corporate Giants Already On Board

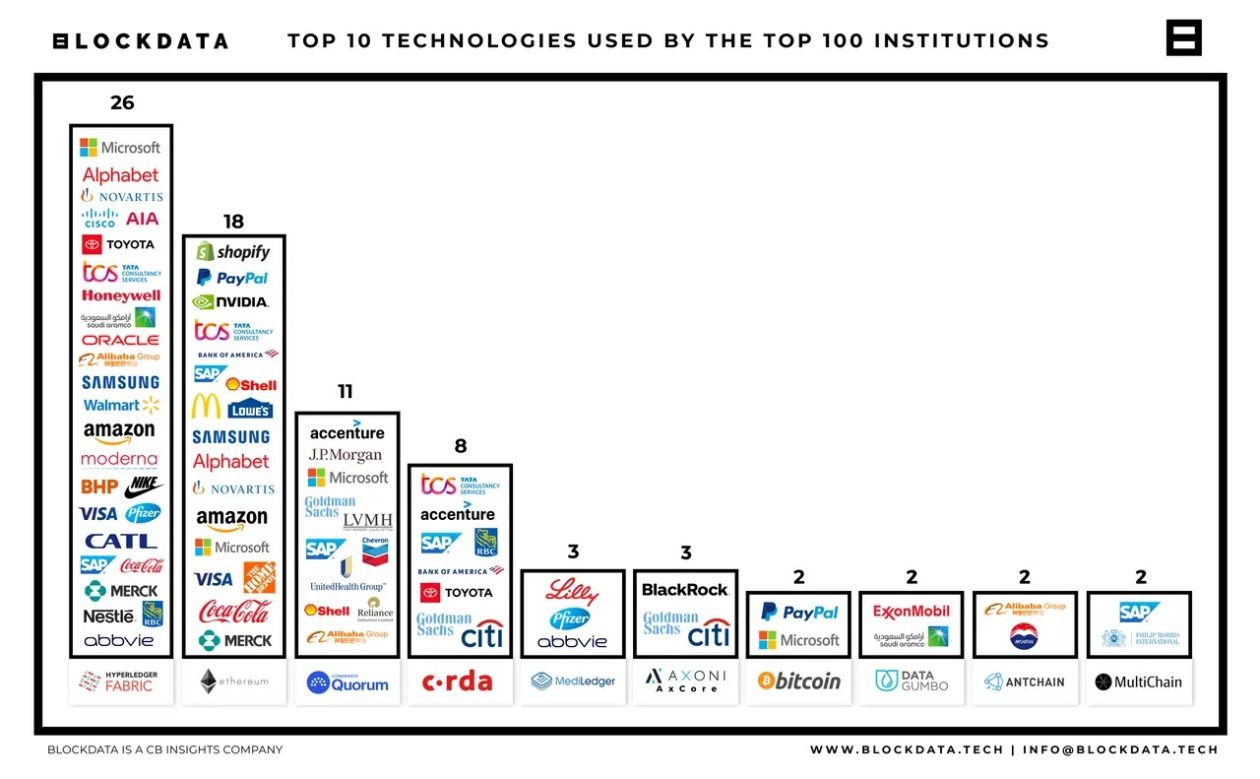

Did you know that 81 of the globe’s top 100 public companies are currently utilising blockchain technology within their business strategy? From tech giants such as Microsoft to well-known brands such as Coca-Cola and Mcdonald’s, a large number of leading institutions are adopting the benefits of blockchain security for digitalised success.

(Image Source: Blockdata)

New findings from Blockdata have revealed that 30 individual DLT technologies are currently being utilised by leading corporate companies, ranging from Hyperledger at a 26% adoption rate to Ethereum at a close 18%.

As tech and financial companies pioneer the way forward with large investments in DLT’s security promise, Tapscott Group’s CEO, Don Tapscott, claims that blockchain’s success within the corporate world is reflected by the hefty sum of venture capital that is being poured into blockchain-based initiatives.

“You’ve got all the smartest venture capitalists, the smartest programmers, the smartest business executives, the smartest people in banking, the smartest government of people, the smartest entrepreneurs all over this thing. That’s always a sign that something big is going on.” He comments. “Last year, $1 billion went into venture alone in this area. I’m more hopeful because I can see the power of the applications to disrupt things for the good.”

As we take a closer look into some of the corporate companies pioneering the way forwards, both financial and insurance-based institutions seem to be most interested in blockchain-based security, in order to keep up with cross-border market trends. Prudential Financial for example has become one of the leading public companies utilising the benefits of blockchain for insurance. The company are using blockchain enhancements to reduce fraudulent activity during transactions while ensuring data protection for their insurance customers by encrypting customer records across a number of networks.

International trading companies are also using IoT based-blockchain to gain more transparency across their platforms and improve supply chain management. Maersk for example is working with DLT technology in order to upload each stage of the supply chain process onto one secure platform, while air cargo shippers such as DHL are using blockchain to speed up tracking verification.

As the possibilities of blockchain continue to expand, it won’t be long until it is used universally across the corporate sector. While the pandemic may have given business leaders a digital push into the future of automation, it’s clear that blockchain’s potential was always destined to shine in the face of corporate security challenges.

“It looks like blockchain is here to stay,’ states Reid Hoffman, the COO of LinkedIn. “I think it’s going to be a powerful technology for modern society.”